Question: Correct answer both question 3C and 3D 3C. Creating an amortization schedule: lan loaned his friend $45,000 to start a new business. He considers this

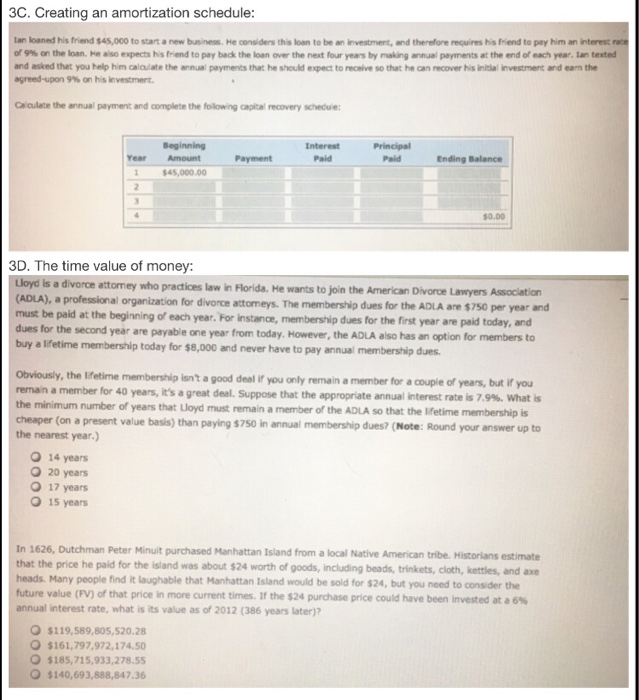

3C. Creating an amortization schedule: lan loaned his friend $45,000 to start a new business. He considers this loan to be an investment, and therefore requires his friend to pay him an interest of9%onthe loan. He aso expects his frend to pay back the loan over the next four years by making annual pements at the end of each year. Ian texted and asked that you help him calulate the annual payments that he should expect to receive so that he can recover his initial investment and earn the agreed-upon 9% on his investment. Caculate the annual payment and complete the foilowing capital recovery schedue: Beginning Principal Paid Year Amount Paid Ending Balance 1$45,000.00 $0.00 3D. The time value of money: Lloyd is a divarce attomey who practices law in Florida. He wants to join the American Divorce Lawyers Association (ADLA), a professional must be paid at the beginning of each year. For instanoe, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lfetime membership today for $8,000 and never have to pay annual membership dues. organization for divorce attomeys. The membership dues for the ADLA are $750 per year and Obviously, the reman a member for 40 years, it's a great deal. Suppose that the appropriate annual interest rate is 7.9%, what is the minimum number of years that Lloyd must remain a member of the ADLA so that the lfetime membership is cheaper (on a present value basis) than paying $750 in annual membership dues? (Note: Round your answer up to the nearest year) lfetime membership isn't a good deal if you only remain a member for a couple of years, but if you O 14 years 20 years O 17 years O 15 years In 1626, Dutchman Peter Minuit purchased Manhattan Island from a local Native American tribe. Historians estimats that the price he paid for the island was about $24 worth of goods, including beads, trinkets, cloth, kettles, and axe heads. Many people find it laughable that Manhattan Island would be sold for $24, but you need to consider the future value (F ) of that price in more current times. If the S24 purchase price could have been invested at a 6% annual interest rate, what is its value as of 2012 (386 years later)? $119,589.80s,520.28 $161,797,972,174.50 O $185,715,933,278.55 $140,693,888,847.36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts