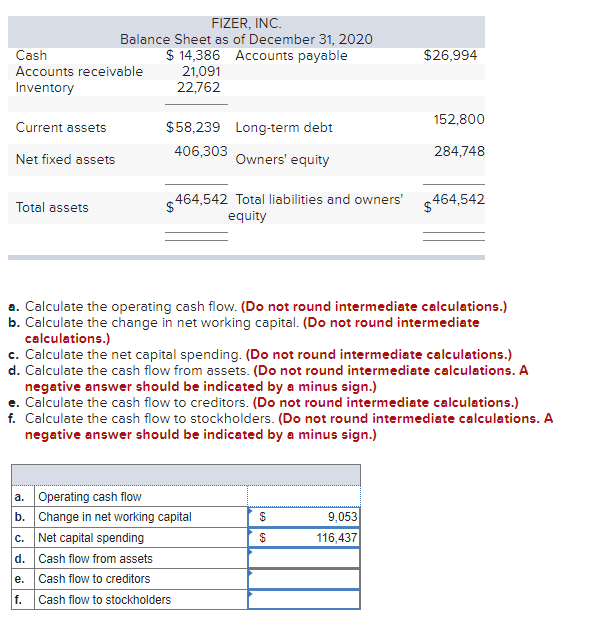

Question: correct answer for d e f only Fizer, Inc., reported the following financial statements for the last two years. FIZER, INC. 2020 Income Statement Sales

correct answer for d e f only

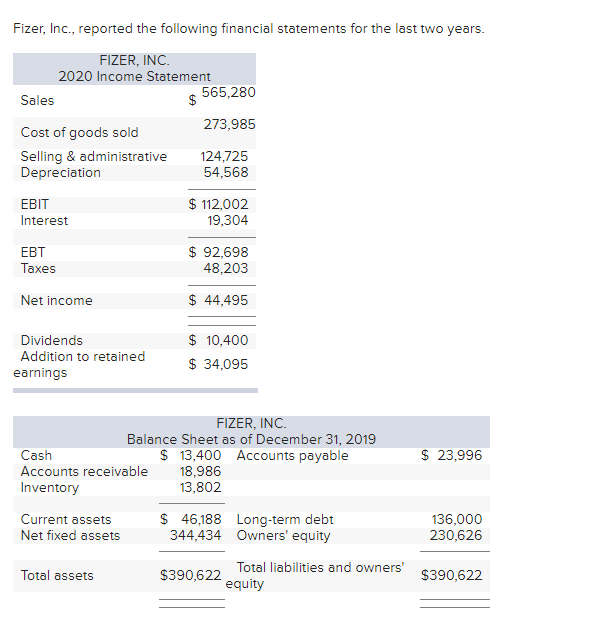

Fizer, Inc., reported the following financial statements for the last two years. FIZER, INC. 2020 Income Statement Sales $ 565,280 Cost of goods sold 273,985 Selling & administrative 124,725 Depreciation 54,568 EBIT Interest $ 112,002 19,304 EBT Taxes $ 92,698 48,203 Net income $ 44,495 Dividends Addition to retained earnings $ 10,400 $ 34,095 $ 23,996 FIZER, INC. Balance Sheet as of December 31, 2019 Cash $ 13,400 Accounts payable Accounts receivable 18,986 Inventory 13,802 Current assets $ 46,188 Long-term debt Net fixed assets 344,434 Owners' equity 136,000 230,626 Total assets Total liabilities and owners' $390,622 equity $390,622 FIZER, INC Balance Sheet as of December 31, 2020 Cash $ 14,386 Accounts payable Accounts receivable 21,091 Inventory 22,762 $26,994 152,800 Current assets $58,239 Long-term debt 406,303 Owners' equity Net fixed assets 284,748 Total assets $464,542 Total liabilities and owners' $464,542 equity a. Calculate the operating cash flow. (Do not round intermediate calculations.) b. Calculate the change in net working capital. (Do not round intermediate calculations.) c. Calculate the net capital spending. (Do not round intermediate calculations.) d. Calculate the cash flow from assets. (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) e. Calculate the cash flow to creditors. (Do not round intermediate calculations.) f. Calculate the cash flow to stockholders. (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) $ 9,053 116,437 $ a. Operating cash flow b. Change in net working capital c. Net capital spending d. Cash flow from assets Cash flow to creditors Cash flow to stockholders e. f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts