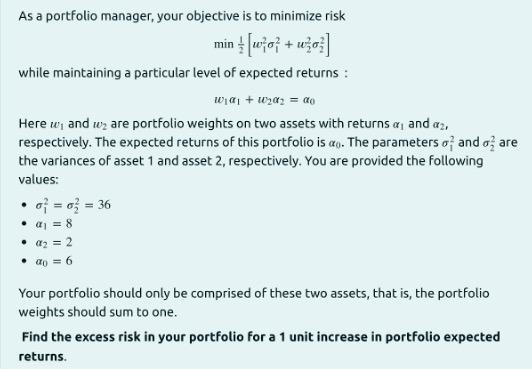

Question: Correct answer is 2. As a portfolio manager, your objective is to minimize risk ${u*o* + u0] while maintaining a particular level of expected returns

Correct answer is 2.

As a portfolio manager, your objective is to minimize risk ${u*o* + u0] while maintaining a particular level of expected returns : wia + w202 = ao Here w; and w, are portfolio weights on two assets with returns a, and az, respectively. The expected returns of this portfolio is ao. The parameters o; and oare the variances of asset 1 and asset 2, respectively. You are provided the following values: o = o ; = 36 a = 8 22 do = 6 Your portfolio should only be comprised of these two assets, that is, the portfolio weights should sum to one. Find the excess risk in your portfolio for a 1 unit increase in portfolio expected returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts