Question: Correct answer is C) Total Payouts for The Company Dividends Repurchases $0.806 $7.703B $0 Total Payouts $8.509 $0 $0.806 $8.509 Yesterday Next Year 2 Years

Correct answer is C)

Correct answer is C)

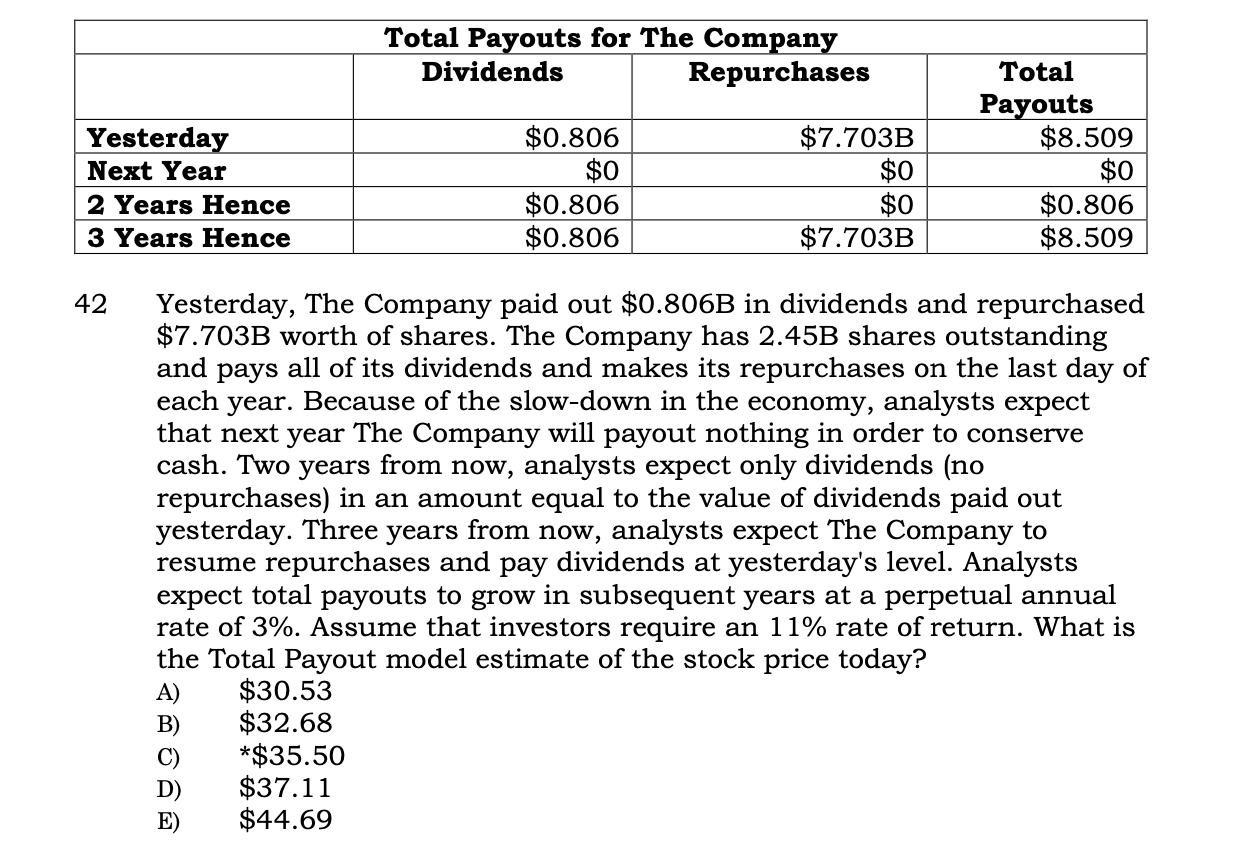

Total Payouts for The Company Dividends Repurchases $0.806 $7.703B $0 Total Payouts $8.509 $0 $0.806 $8.509 Yesterday Next Year 2 Years Hence 3 Years Hence $0 $0 $0.806 $0.806 $7.703B 42 Yesterday, The Company paid out $0.806B in dividends and repurchased $7.703B worth of shares. The Company has 2.45B shares outstanding and pays all of its dividends and makes its repurchases on the last day of each year. Because of the slow-down in the economy, analysts expect that next year The Company will payout nothing in order to conserve cash. Two years from now, analysts expect only dividends (no repurchases) in an amount equal to the value of dividends paid out yesterday. Three years from now, analysts expect The Company to resume repurchases and pay dividends at yesterday's level. Analysts expect total payouts to grow in subsequent years at a perpetual annual rate of 3%. Assume that investors require an 11% rate of return. What is the Total Payout model estimate of the stock price today? $30.53 B) $32.68 *$35.50 D) $37.11 $44.69 A)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts