Question: Correct Answer is provided. I just can't figure out how to get there. Question 2 0 out of 10 points A market value weighted index

Correct Answer is provided. I just can't figure out how to get there.

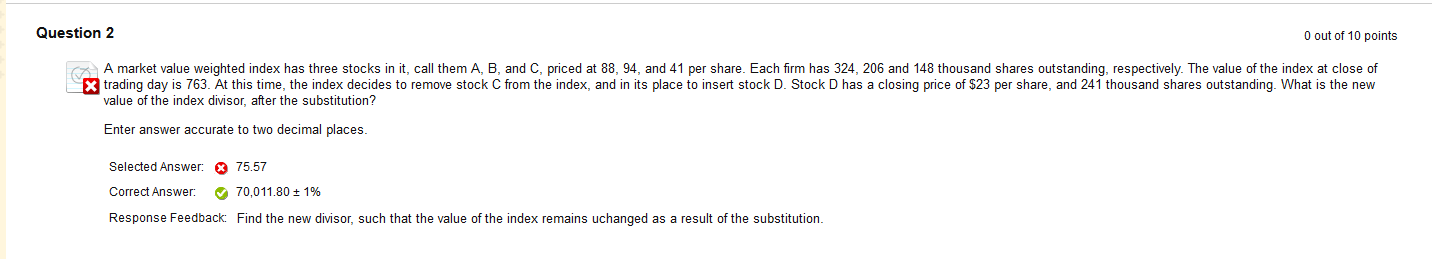

Question 2 0 out of 10 points A market value weighted index has three stocks in it, call them A, B, and C, priced at 88, 94, and 41 per share. Each firm has 324, 206 and 148 thousand shares outstanding, respectively. The value of the index at close of x trading day is 763. At this time, the index decides to remove stock C from the index, and in its place to insert stock D. Stock D has a closing price of $23 per share, and 241 thousand shares outstanding. What is the new value of the index divisor, after the substitution? Enter answer accurate to two decimal places. Selected Answer: 75.57 Correct Answer: 70,011.80 1% Response Feedback: Find the new divisor, such that the value of the index remains uchanged as a result of the substitution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts