Question: CORRECT ANSWER IS THERE. JUST NEED HELP WITH CALCULATIONS! THANK YOU 11) A U.S. importer has to pay Euros 400,000 in 1-year. The importer decides

CORRECT ANSWER IS THERE. JUST NEED HELP WITH CALCULATIONS!

THANK YOU

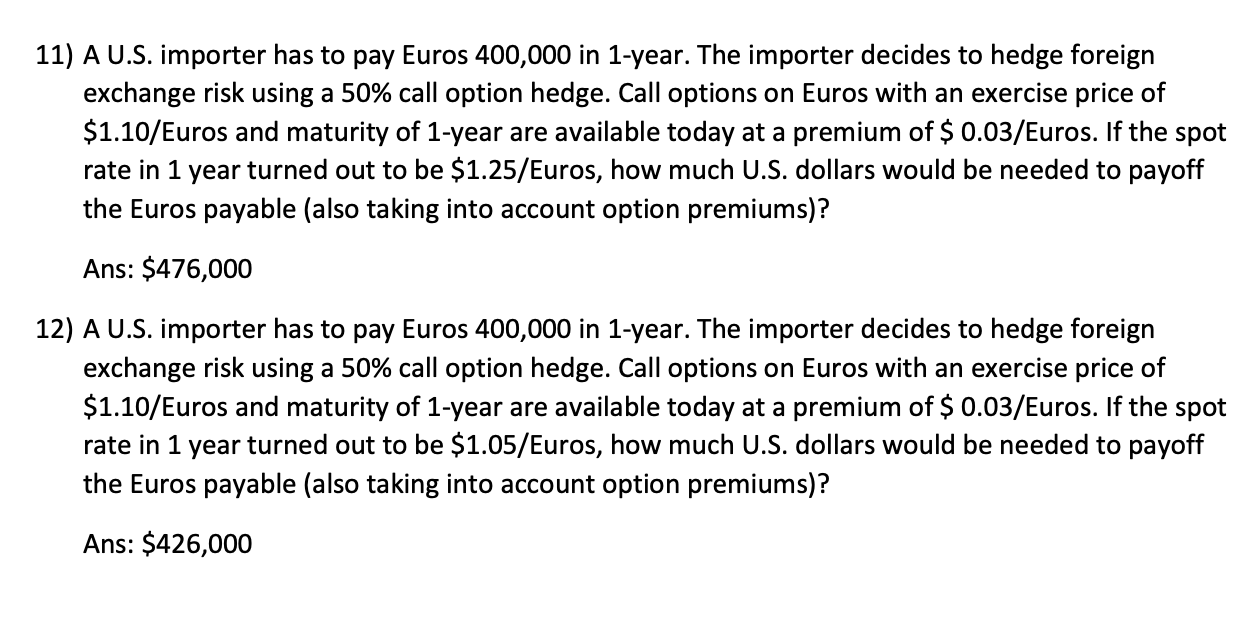

11) A U.S. importer has to pay Euros 400,000 in 1-year. The importer decides to hedge foreign exchange risk using a 50% call option hedge. Call options on Euros with an exercise price of $1.10 /Euros and maturity of 1-year are available today at a premium of $0.03 /Euros. If the spot rate in 1 year turned out to be $1.25 /Euros, how much U.S. dollars would be needed to payoff the Euros payable (also taking into account option premiums)? Ans: $476,000 12) A U.S. importer has to pay Euros 400,000 in 1-year. The importer decides to hedge foreign exchange risk using a 50% call option hedge. Call options on Euros with an exercise price of $1.10/ Euros and maturity of 1-year are available today at a premium of $0.03 /Euros. If the spot rate in 1 year turned out to be $1.05 /Euros, how much U.S. dollars would be needed to payoff the Euros payable (also taking into account option premiums)? Ans: $426,000 11) A U.S. importer has to pay Euros 400,000 in 1-year. The importer decides to hedge foreign exchange risk using a 50% call option hedge. Call options on Euros with an exercise price of $1.10 /Euros and maturity of 1-year are available today at a premium of $0.03 /Euros. If the spot rate in 1 year turned out to be $1.25 /Euros, how much U.S. dollars would be needed to payoff the Euros payable (also taking into account option premiums)? Ans: $476,000 12) A U.S. importer has to pay Euros 400,000 in 1-year. The importer decides to hedge foreign exchange risk using a 50% call option hedge. Call options on Euros with an exercise price of $1.10/ Euros and maturity of 1-year are available today at a premium of $0.03 /Euros. If the spot rate in 1 year turned out to be $1.05 /Euros, how much U.S. dollars would be needed to payoff the Euros payable (also taking into account option premiums)? Ans: $426,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts