Question: Correct or incorrect answers? Please include steps with your solutions. 1 Payout policy 1. FM Donut Bakery's net income for the current year is $2

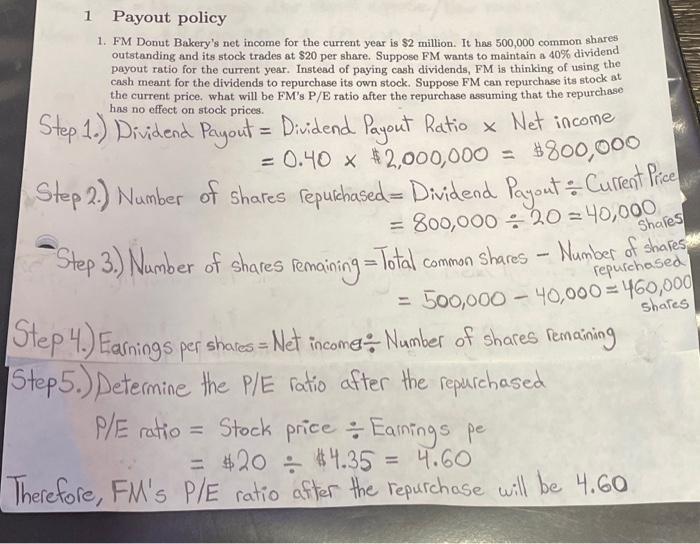

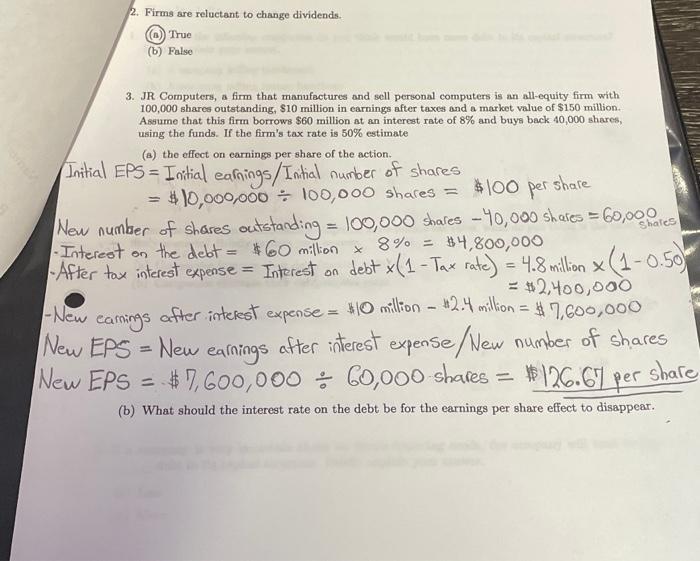

1 Payout policy 1. FM Donut Bakery's net income for the current year is $2 million. It has 500,000 common shares outstanding and its stock trades at $20 per share. Suppose FM wants to maintain a 40% dividend payout ratio for the current year. Instead of paying cash dividends, FM is thinking of using the cash meant for the dividends to repurchase its own stock. Suppose FM can repurchase its stock at the current price, what will be FM's P/E ratio after the repurchase assuming that the repurchase has no effect on stock prices. Step 1.) Dividend Payout = Dividend Payout Ratio Net income =0.40$2,000,000=$800,000 Step 2.) Number of sharesrepuichased=DividendPayoutCurrentPric=800,00020=40,000 Step 3.) Number of shares remaining = Total common shares - Number of shar repurchase =500,00040,000=shar460,0 Step 4.) Earnings per shares = Net income Number of shares remaining Step5.) Determine the P/E ratio after the repurchased P/Eratio=StockpriceEarningspe=$20$4.35=4.60 herefore, FM's P/E ratio after the repurchase will be 4.60 2. Firms are reluctant to change dividends. (B) True (b) False 3. JR Computers, a firm that manufactures and sell personal computers is an all-equity firm with 100,000 shares outstanding, $10 million in carnings after taxes and a market value of $150 million. Assume that this firm borrows $60 million at an interest rate of 8% and buys back 40,000 shares, using the funds. If the firm's tax rate is 50% estimate (a) the effect on earnings per share of the action. Initial EPS = Initial earnings/Initial number of shares =$10,000,000100,000shares=$100pershare New number of shares outstanding =100,000 shares 40,000 shares =60,000 shares - Interest on the debt =$60 million 8%=$4,800,000 - After tax interest expense = Interest on debt x(1Ta rate )=4.8 million x(10.50) =$2,400,000 - New earnings after interest expense =$10 million - $2.4 miltion =$7,600,000 New EPS = New earnings after interest expense/New number of shares New EPS =$7,600,00060,000 shares =$26.67 per shar (b) What should the interest rate on the debt be for the earnings per share effect to disappear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts