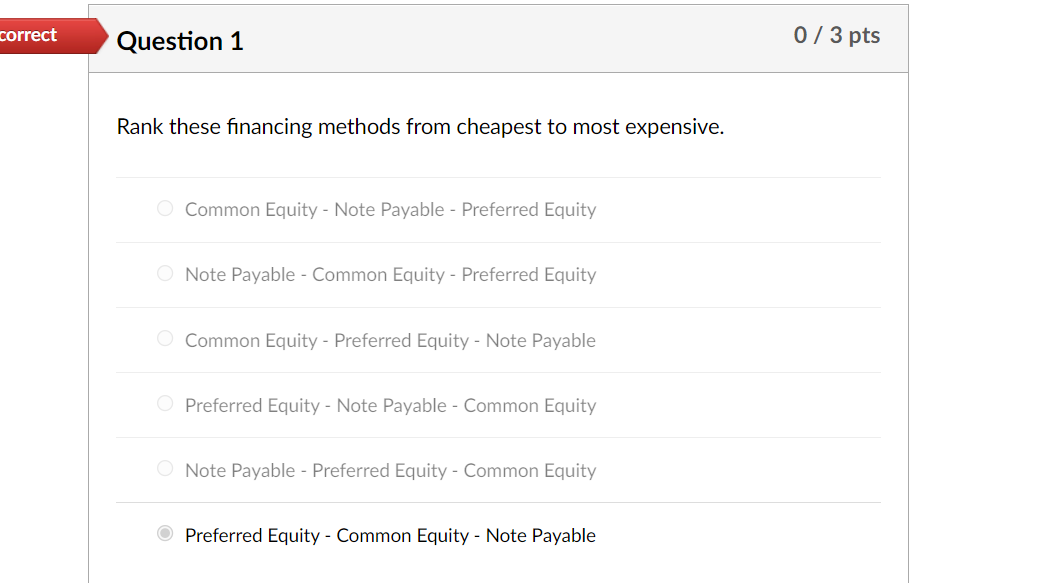

Question: correct Question 1 0/3 pts Rank these financing methods from cheapest to most expensive. O Common Equity - Note Payable - Preferred Equity O Note

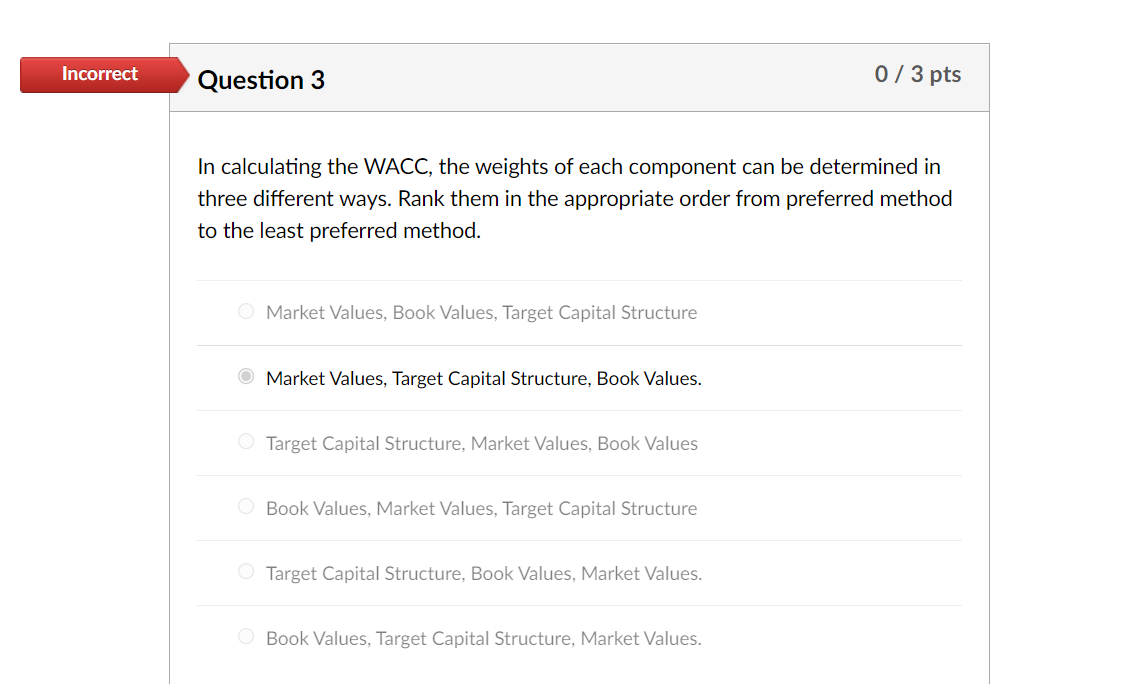

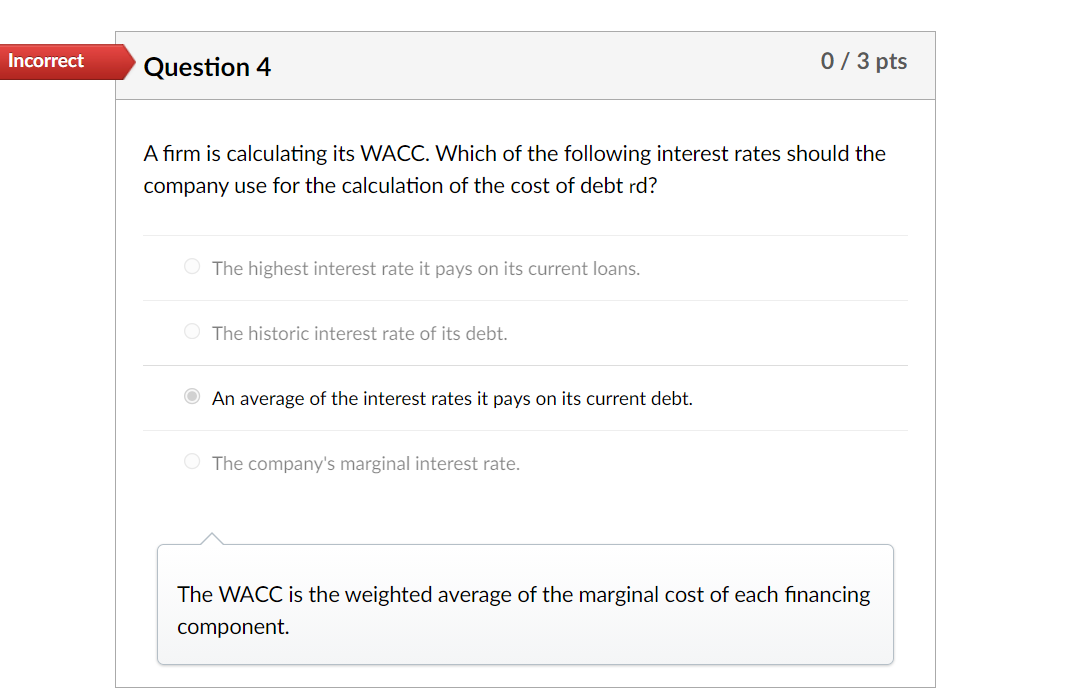

correct Question 1 0/3 pts Rank these financing methods from cheapest to most expensive. O Common Equity - Note Payable - Preferred Equity O Note Payable - Common Equity - Preferred Equity Common Equity - Preferred Equity - Note Payable Preferred Equity - Note Payable - Common Equity Note Payable - Preferred Equity - Common Equity Preferred Equity - Common Equity - Note Payable Incorrect Question 3 0/3 pts In calculating the WACC, the weights of each component can be determined in three different ways. Rank them in the appropriate order from preferred method to the least preferred method. O Market Values, Book Values, Target Capital Structure Market Values, Target Capital Structure, Book Values. O Target Capital Structure, Market Values, Book Values o Book Values, Market Values, Target Capital Structure O Target Capital Structure, Book Values, Market Values. Book Values, Target Capital Structure, Market Values. Incorrect Question 4 0/3 pts A firm is calculating its WACC. Which of the following interest rates should the company use for the calculation of the cost of debt rd? O The highest interest rate it pays on its current loans. The historic interest rate of its debt. An average of the interest rates it pays on its current debt. The company's marginal interest rate. The WACC is the weighted average of the marginal cost of each financing component

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts