Question: correct the incorrect statements Accordingly, please MAKE CORRECTIONS to the incorrect statement(s). (1) According to pecking order theory, the firm will use the debt first

correct the incorrect statements

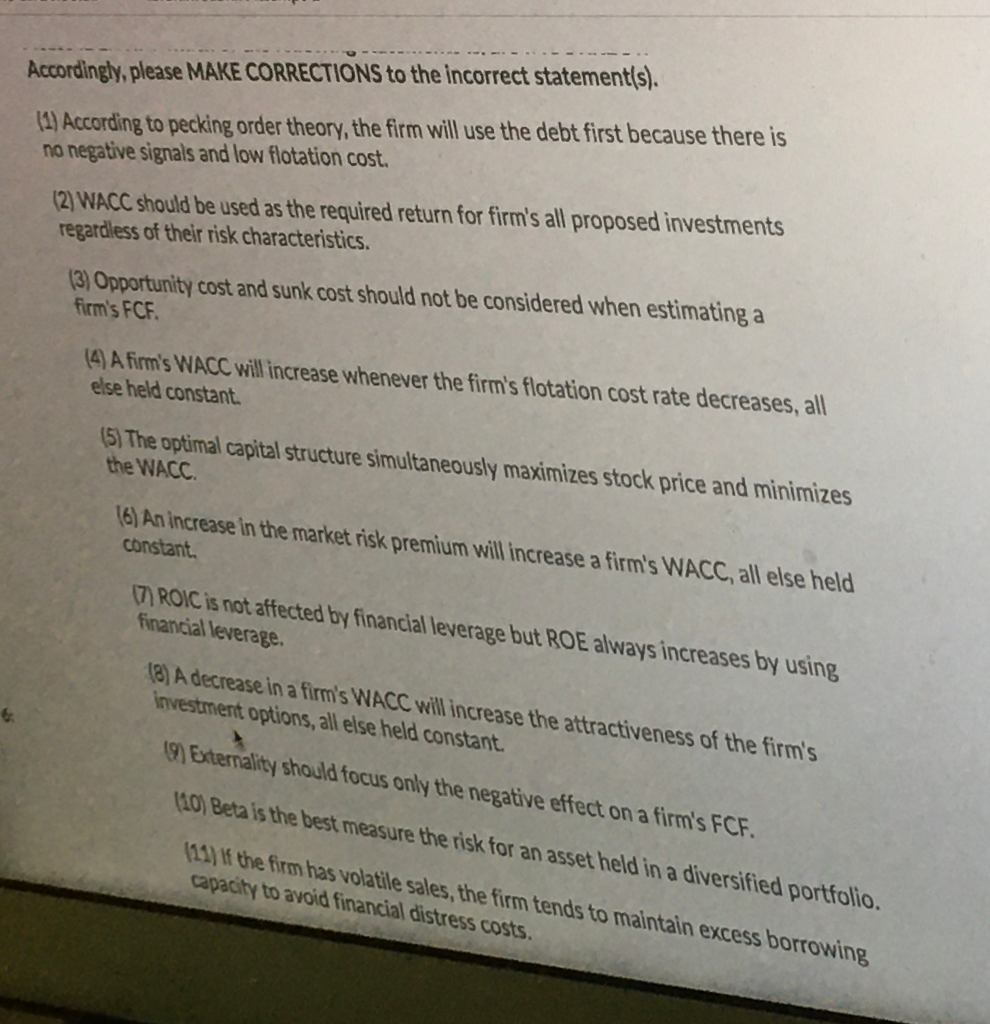

Accordingly, please MAKE CORRECTIONS to the incorrect statement(s). (1) According to pecking order theory, the firm will use the debt first because there is no negative signals and low flotation cost. (2) WACC should be used as the required return for firm's all proposed investments regardless of their risk characteristics. (3) Opportunity cost and sunk cost should not be considered when estimating a firm's FCF. (4) A firm's WACC will increase whenever the firm's flotation cost rate decreases, all else held constant. (5) The optimal capital structure simultaneously maximizes stock price and minimizes the WACC. 16) An increase in the market risk premium will increase a firm's WACC, all else held constant. (7) ROIC is not affected by financial leverage but ROE always increases by using financial leverage (8) A decrease in a firm's WACC will increase the attractiveness of the firm's investment options, all else held constant. (9) Externality should focus only the negative effect on a firm's FCF. (10) Beta is the best measure the risk for an asset held in a diversified portfolio. (11) If the firm has volatile sales, the firm tends to maintain excess borrowing capacity to avoid financial distress costs. Accordingly, please MAKE CORRECTIONS to the incorrect statement(s). (1) According to pecking order theory, the firm will use the debt first because there is no negative signals and low flotation cost. (2) WACC should be used as the required return for firm's all proposed investments regardless of their risk characteristics. (3) Opportunity cost and sunk cost should not be considered when estimating a firm's FCF. (4) A firm's WACC will increase whenever the firm's flotation cost rate decreases, all else held constant. (5) The optimal capital structure simultaneously maximizes stock price and minimizes the WACC. 16) An increase in the market risk premium will increase a firm's WACC, all else held constant. (7) ROIC is not affected by financial leverage but ROE always increases by using financial leverage (8) A decrease in a firm's WACC will increase the attractiveness of the firm's investment options, all else held constant. (9) Externality should focus only the negative effect on a firm's FCF. (10) Beta is the best measure the risk for an asset held in a diversified portfolio. (11) If the firm has volatile sales, the firm tends to maintain excess borrowing capacity to avoid financial distress costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts