Question: correct the wrong questions below and explain your reasoning and calculations for the new answer ~ 015 points Return to questio Which method involves the

correct the wrong questions below and explain your reasoning and calculations for the new answer

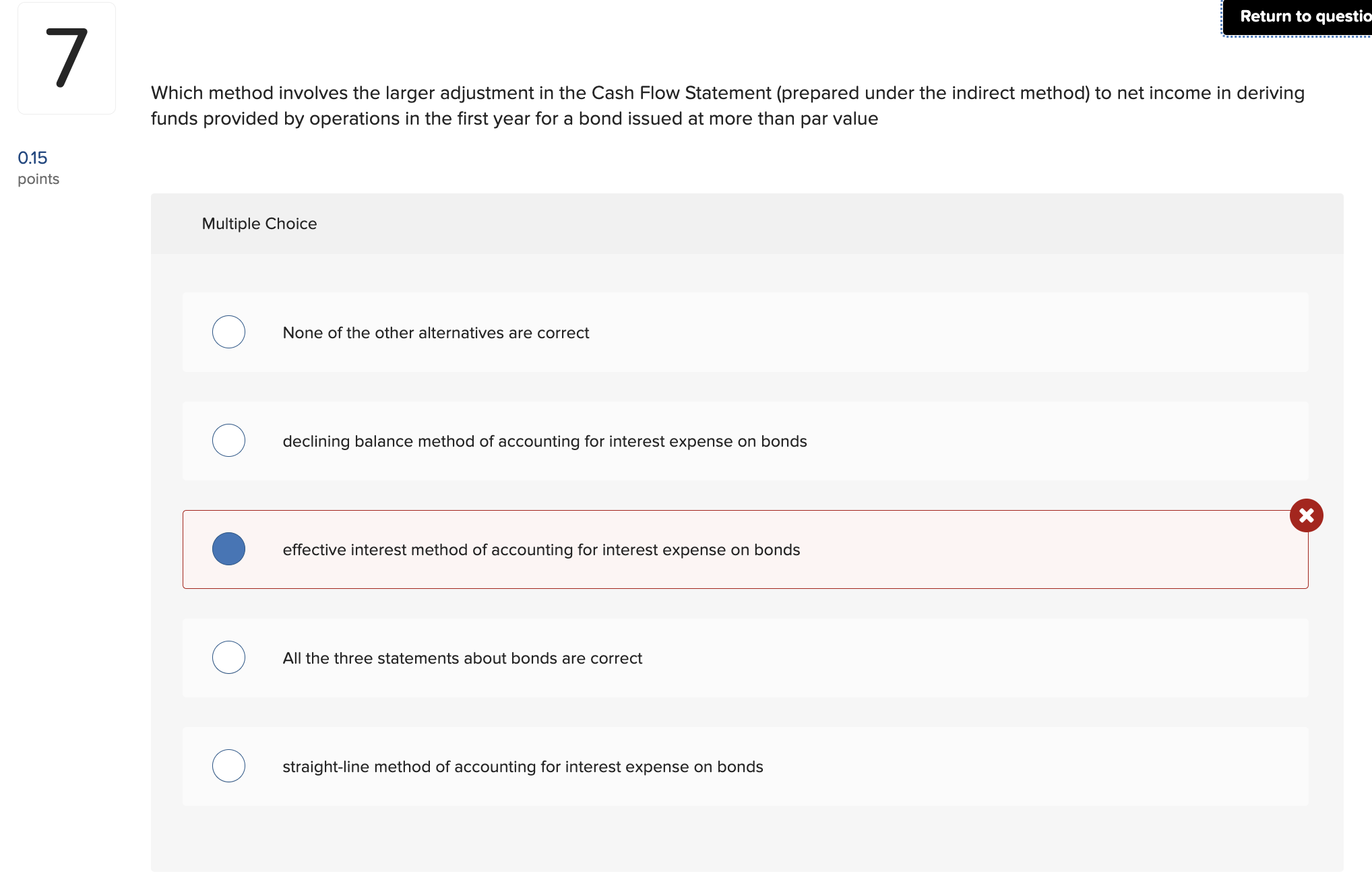

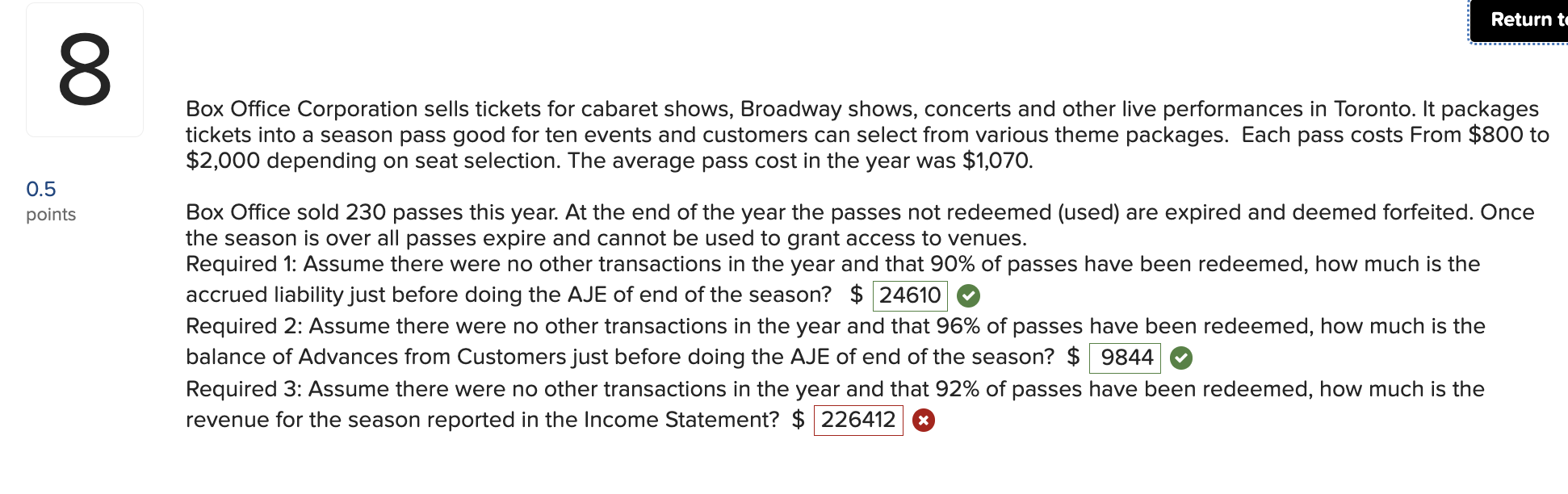

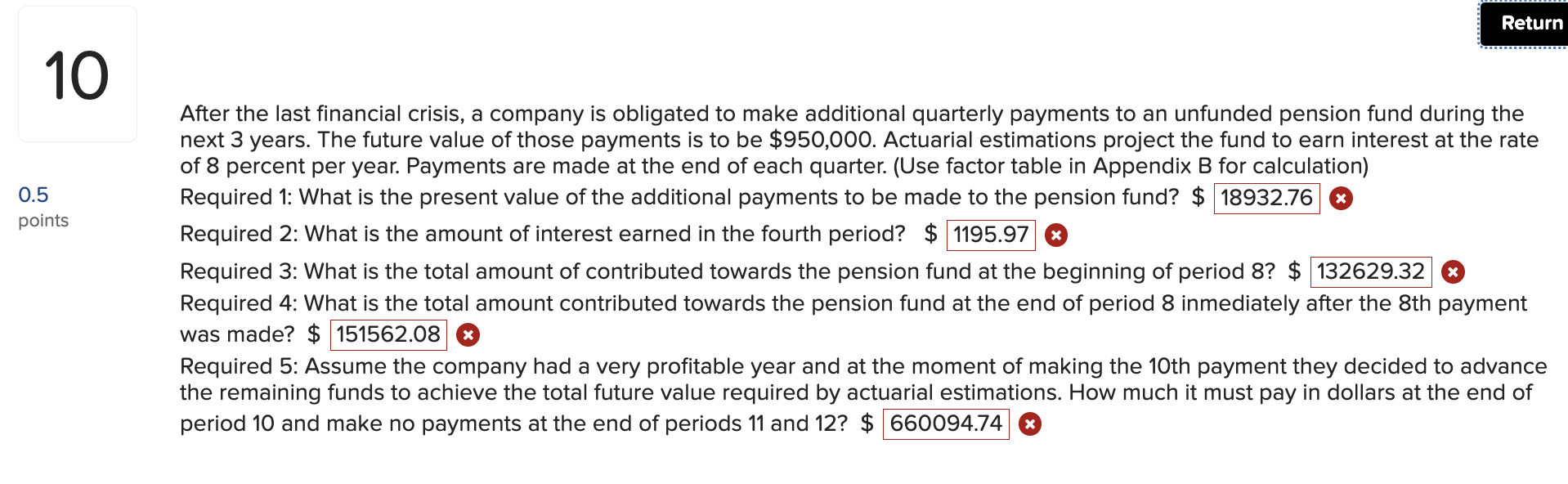

~ 015 points Return to questio Which method involves the larger adjustment in the Cash Flow Statement (prepared under the indirect method) to net income in deriving funds provided by operations in the first year for a bond issued at more than par value Multiple Choice 2 . '\\ /' None of the other alternatives are correct declining balance method of accounting for interest expense on bonds effective interest method of accounting for interest expense on bonds All the three statements about bonds are correct straight-line method of accounting for interest expense on bonds Box Office Corporation sells tickets for cabaret shows, Broadway shows, concerts and other live performances in Toronto. It packages tickets into a season pass good for ten events and customers can select from various theme packages. Each pass costs From $800 to $2,000 depending on seat selection. The average pass cost in the year was $1,070. 0.5 points Box Office sold 230 passes this year. At the end of the year the passes not redeemed (used) are expired and deemed forfeited. Once the season is over all passes expire and cannot be used to grant access to venues. Required 1: Assume there were no other transactions in the year and that 90% of passes have been redeemed, how much is the accrued liability just before doing the AJE of end of the season? $ o Required 2: Assume there were no other transactions in the year and that 96% of passes have been redeemed, how much is the balance of Advances from Customers just before doing the AJE of end of the season? $ 9844 @ Required 3: Assume there were no other transactions in the year and that 92% of passes have been redeemed, how much is the revenue for the season reported in the Income Statement? $ | 226412 0 Required 2: What is the amount of interest earned in the fourth period? $ o Required 3: What is the total amount of contributed towards the pension fund at the beginning of period 8? $ Required 4: What is the total amount contributed towards the pension fund at the end of period 8 inmediately after the 8th payment was made? $ Required 5: Assume the company had a very profitable year and at the moment of making the 10th payment they decided to advance the remaining funds to achieve the total future value required by actuarial estimations. How much it must pay in dollars at the end of period 10 and make no payments at the end of periods 11and 12? $ o After the last financial crisis, a company is obligated to make additional quarterly payments to an unfunded pension fund during the next 3 years. The future value of those payments is to be $950,000. Actuarial estimations project the fund to earn interest at the rate of 8 percent per year. Payments are made at the end of each quarter. (Use factor table in Appendix B for calculation) Required 1: What is the present value of the additional payments to be made to the pension fund? $ o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts