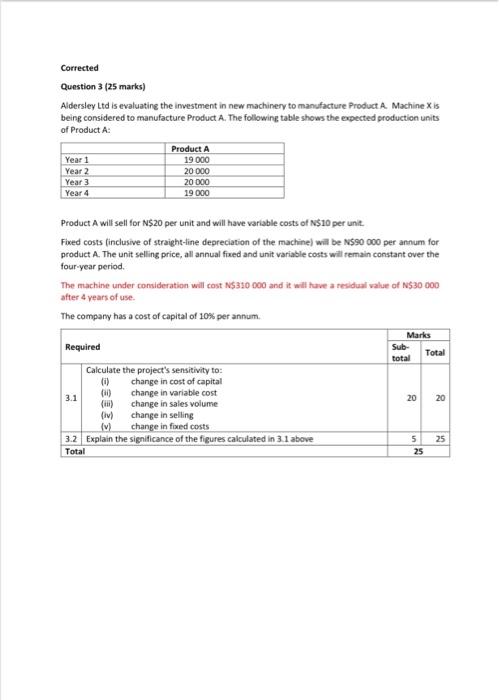

Question: Corrected Question 3 (25 marks) Aldersley Ltd is evaluating the investment in new machinery to manufacture Product A. Machine X is being considered to manufacture

Question 3 (25 marks) Aldersley Ltd is evaluatine the imvestment in new machinery to manufacture Product A. Machine X is being considered to manufacture Product A. The following table shows the expected production units of Product A: Product A will sell for N\$20 per unit and will have variable costs of N\$10 per unit. Fixed costs (inclusive of straight-line depreciation of the machine) will be NS90 000 per annum for: product A. The unit selling price, all annual fixed and unit variable costs will remain constant over the four-year period. The machine under consideration will cost NS310 000 and it will huve a residual value of N530 000 after 4 vears of use. The company has a cost of capital of 10% per annum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts