Question: Correcting Errors 1. The following entry was made to record the purchase of $600 in supplies on account: Supplies 142 600 Cash 101 600 2.

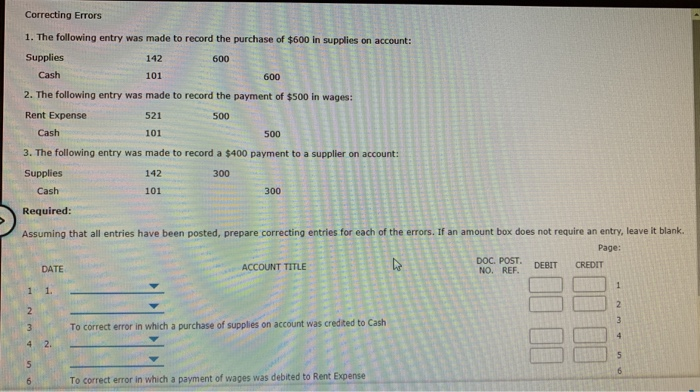

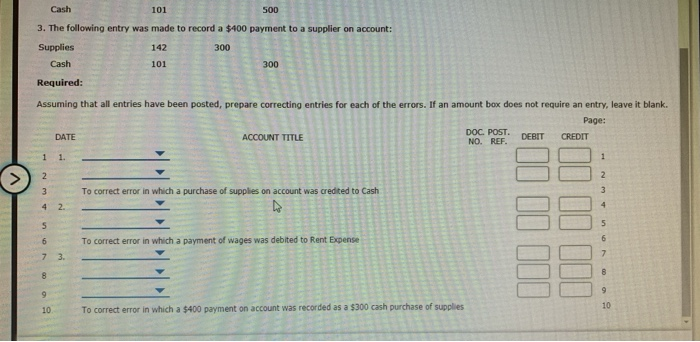

Correcting Errors 1. The following entry was made to record the purchase of $600 in supplies on account: Supplies 142 600 Cash 101 600 2. The following entry was made to record the payment of $500 in wages: Rent Expense 521 500 Cash 101 500 3. The following entry was made to record a $400 payment to a supplier on account: 142 300 Supplies Cash 101 300 Required: Assuming that all entries have been posted, prepare correcting entries for each of the errors. If an amount box does not require an entry, leave it blank. Page: DOC. POST DATE ACCOUNT TITLE CREDIT DEBIT NO. REF. 1 1 1. 2 2 3 3 To correct error in which a purchase of supplies on account was credited to Cash 4 2 5 5 6 6 To correct error in which a payment of wages was debited to Rent Expense Cash 101 500 3. The following entry was made to record a $400 payment to a supplier on account: Supplies 142 300 Cash 101 300 Required: Assuming that all entries have been posted, prepare correcting entries for each of the errors. If an amount box does not require an entry, leave it blank. Page: DOC. POST ACCOUNT TITLE DEBIT CREDIT NO. REF DATE 1. 1 2 2 3 To correct error in which a purchase of supplies on account was credited to Cash 3 4 2. S 5 6 To correct error in which a payment of wages was debited to Rent Expense 7 7 3. 8 B 03 9 9 10 10 To correct error in which a $400 payment on account was recorded as a $300 cash purchase of supplies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts