Question: correlation coefficient between risk free rate and optimal portfolio is 0. . 0 F G H I Questions #3A, 3B, & 3C: Given the Risk

correlation coefficient between risk free rate and optimal portfolio is 0.

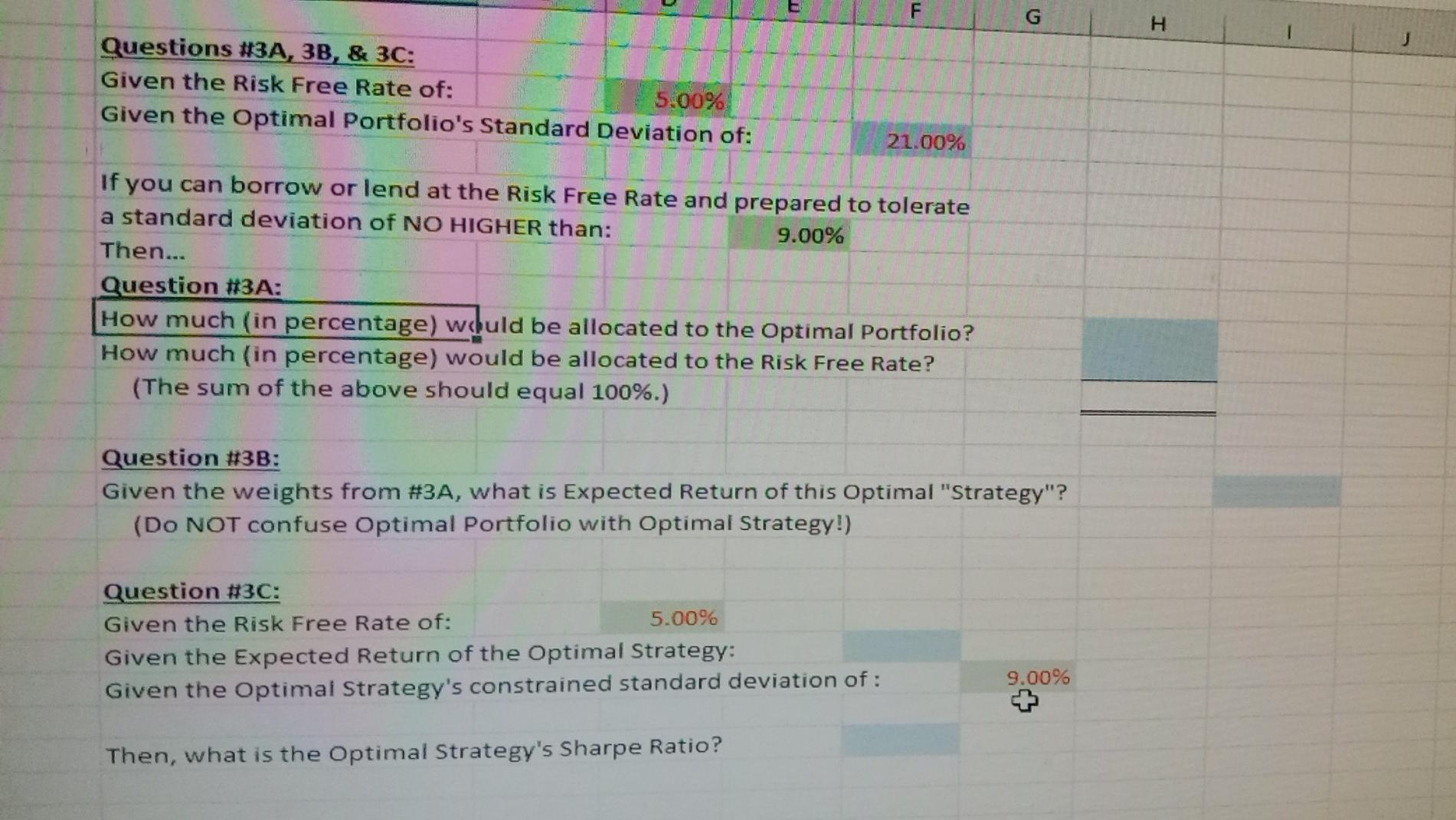

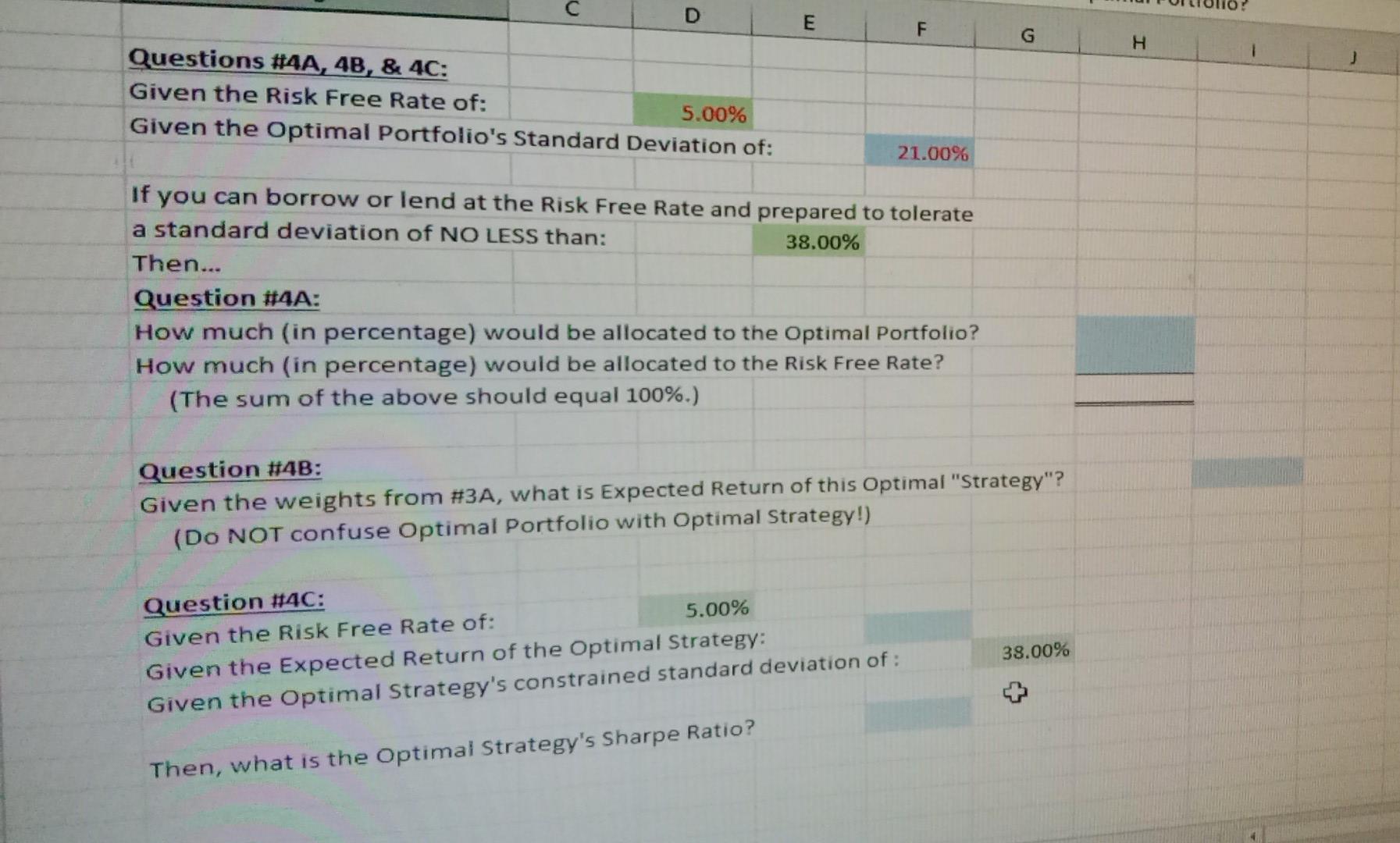

. 0 F G H I Questions #3A, 3B, & 3C: Given the Risk Free Rate of: 5.00% Given the optimal Portfolio's Standard Deviation of: 21.00% If you can borrow or lend at the Risk Free Rate and prepared to tolerate a standard deviation of NO HIGHER than: 9.00% Then... Question #3A: How much (in percentage) would be allocated to the Optimal Portfolio? How much (in percentage) would be allocated to the Risk Free Rate? (The sum of the above should equal 100%.) Question #3B: Given the weights from #3A, what is expected Return of this Optimal "Strategy"? (Do NOT confuse Optimal Portfolio with Optimal Strategy!) Question #3C: Given the Risk Free Rate of: 5.00% Given the Expected Return of the Optimal Strategy: Given the optimal Strategy's constrained standard deviation of: 9.00% Then, what is the optimal Strategy's Sharpe Ratio? D E TI F G H I Questions #4A, 4B, & 4C: Given the Risk Free Rate of: 5.00% Given the optimal Portfolio's Standard Deviation of: 21.00% If you can borrow or lend at the Risk Free Rate and prepared to tolerate a standard deviation of NO LESS than: 38.00% Then... Question #4A: How much (in percentage) would be allocated to the Optimal Portfolio? How much in percentage) would be allocated to the Risk Free Rate? (The sum of the above should equal 100%.) Question #4B: Given the weights from #3A, what is expected Return of this Optimal "Strategy"? (Do NOT confuse Optimal Portfolio with Optimal Strategy!) Question #4C: Given the Risk Free Rate of: 5.00% Given the Expected Return of the Optimal Strategy: Given the optimal Strategy's constrained standard deviation of: 38.00% Then, what is the optimal Strategy's Sharpe Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts