Question: Correlation coefficient is 0.83 pls hand write maths is possible thanks For simplicity and convenience of calculation, suppose there are only one risk-free asset with

Correlation coefficient is 0.83

pls hand write maths is possible thanks

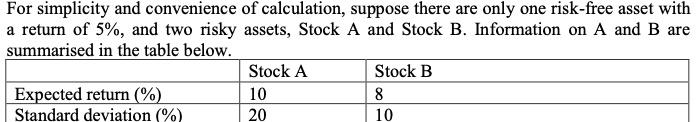

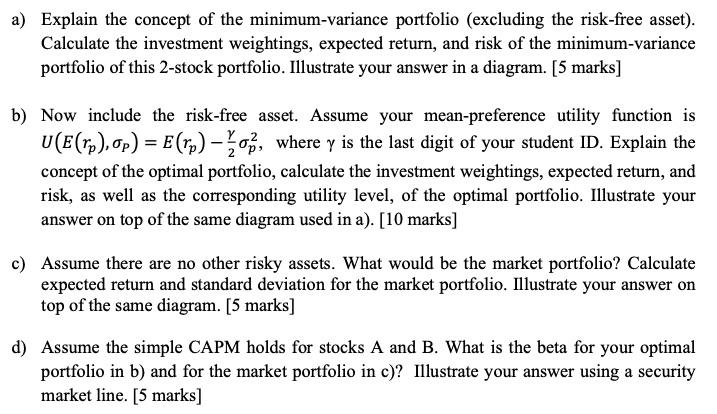

For simplicity and convenience of calculation, suppose there are only one risk-free asset with a return of 5%, and two risky assets, Stock A and Stock B. Information on A and B are summarised in the table below. a) Explain the concept of the minimum-variance portfolio (excluding the risk-free asset). Calculate the investment weightings, expected return, and risk of the minimum-variance portfolio of this 2-stock portfolio. Illustrate your answer in a diagram. [5 marks] b) Now include the risk-free asset. Assume your mean-preference utility function is U(E(rp),P)=E(rp)2p2, where is the last digit of your student ID. Explain the concept of the optimal portfolio, calculate the investment weightings, expected return, and risk, as well as the corresponding utility level, of the optimal portfolio. Illustrate your answer on top of the same diagram used in a). [ 10 marks] c) Assume there are no other risky assets. What would be the market portfolio? Calculate expected return and standard deviation for the market portfolio. Illustrate your answer on top of the same diagram. [5 marks] d) Assume the simple CAPM holds for stocks A and B. What is the beta for your optimal portfolio in b) and for the market portfolio in c)? Illustrate your answer using a security market line. [5 marks] For simplicity and convenience of calculation, suppose there are only one risk-free asset with a return of 5%, and two risky assets, Stock A and Stock B. Information on A and B are summarised in the table below. a) Explain the concept of the minimum-variance portfolio (excluding the risk-free asset). Calculate the investment weightings, expected return, and risk of the minimum-variance portfolio of this 2-stock portfolio. Illustrate your answer in a diagram. [5 marks] b) Now include the risk-free asset. Assume your mean-preference utility function is U(E(rp),P)=E(rp)2p2, where is the last digit of your student ID. Explain the concept of the optimal portfolio, calculate the investment weightings, expected return, and risk, as well as the corresponding utility level, of the optimal portfolio. Illustrate your answer on top of the same diagram used in a). [ 10 marks] c) Assume there are no other risky assets. What would be the market portfolio? Calculate expected return and standard deviation for the market portfolio. Illustrate your answer on top of the same diagram. [5 marks] d) Assume the simple CAPM holds for stocks A and B. What is the beta for your optimal portfolio in b) and for the market portfolio in c)? Illustrate your answer using a security market line. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts