Question: COST ACCOUNTING - ACTIVITY BASED COSTING Please write the calculation in details and clearly, will vote ! Sin Max Sdn Bhd manufactures two products, PREMIUM

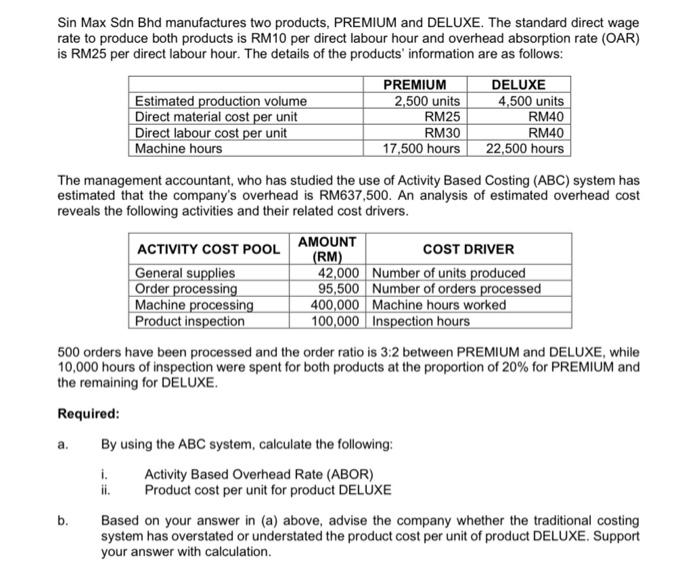

Sin Max Sdn Bhd manufactures two products, PREMIUM and DELUXE. The standard direct wage rate to produce both products is RM10 per direct labour hour and overhead absorption rate (OAR) is RM25 per direct labour hour. The details of the products' information are as follows: The management accountant, who has studied the use of Activity Based Costing (ABC) system has estimated that the company's overhead is RM637,500. An analysis of estimated overhead cost reveals the following activities and their related cost drivers. 500 orders have been processed and the order ratio is 3:2 between PREMIUM and DELUXE, while 10,000 hours of inspection were spent for both products at the proportion of 20% for PREMIUM and the remaining for DELUXE. Required: a. By using the ABC system, calculate the following: i. Activity Based Overhead Rate (ABOR) ii. Product cost per unit for product DELUXE b. Based on your answer in (a) above, advise the company whether the traditional costing system has overstated or understated the product cost per unit of product DELUXE. Support your answer with calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts