Question: cost accounting problem please solve showing the steps and everything Q2 (1): A machining facility specialized in jobs of aircraft-components market implements a simple costing

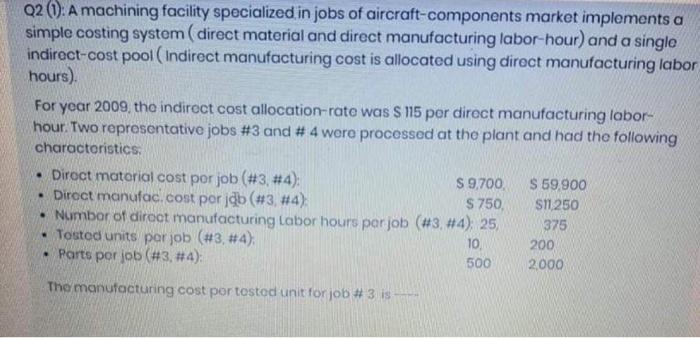

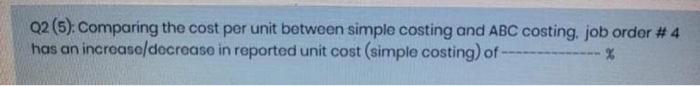

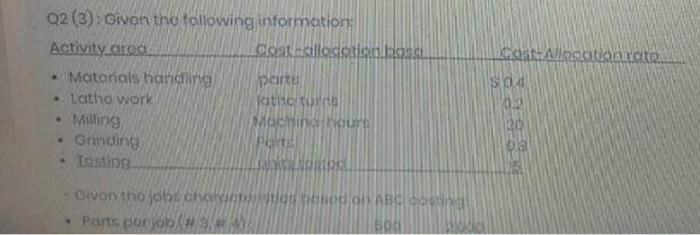

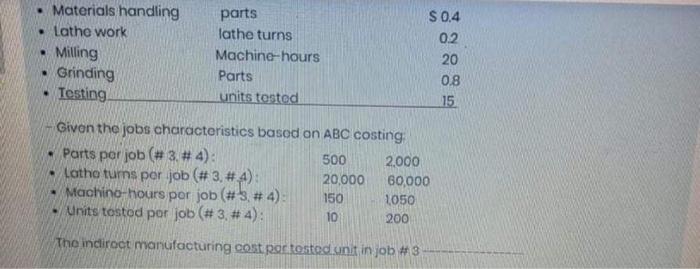

Q2 (1): A machining facility specialized in jobs of aircraft-components market implements a simple costing system (direct material and direct manufacturing labor-hour) and a single indirect-cost pool (Indirect manufacturing cost is allocated using direct manufacturing labor hours). For year 2009, the indirect cost allocation-rate was $ 115 per direct manufacturing labor- hour. Two representative jobs #3 and # 4 were processed at the plant and had the following characteristics: Direct material cost por job (#3, #4): $ 9,700, $ 59,900 . Direct manufac. cost por jdb (#3, #4) $750, $11,250 Number of direct manufacturing Labor hours par job (#3, #4): 25, 375 Tosted units par job (#3, #4): 10, Parts por job (#3, #4): 500 The manufacturing cost por tested unit for job # 3 is 200 2,000 Q2 (2) Using simple costing, the manufacturing cost per tasted unit for job # 4 is- Q2 (4): The manufacturing cost per unit for job # 4 is- Q2 (5): Comparing the cost per unit between simple costing and ABC costing, job order # 4 has an in reported unit cost (simple costing) of - increase/decrease % Q2 (3): Givon the following information: Activity area Cost-allocation bass Materials handling parto Latho work kathic turds Milling Maching hours Grinding Parte - Tasting JADIER FORTRES Givon the jobs characteristlos bosed on ABC parti Parts purjob (#3, #4 600 . Cast Allocation rate $04 02 Materials handling parts . Lathe work lathe turns . Milling Machine-hours Grinding Parts Testing. units tosted Given the jobs characteristics based on ABC costing Parts per job (#3, #4): 500 2,000 Lathe turns por job (#3, #4): 20,000 60,000 150 1050 Machino-hours per job (#3, #4): Units tostod por job (#3, #4): 10 200 The indirect manufacturing cost por tostod unit in job #3 $0.4 0.2 20 0.8 15 Q2 (1): A machining facility specialized in jobs of aircraft-components market implements a simple costing system (direct material and direct manufacturing labor-hour) and a single indirect-cost pool (Indirect manufacturing cost is allocated using direct manufacturing labor hours). For year 2009, the indirect cost allocation-rate was $ 115 per direct manufacturing labor- hour. Two representative jobs #3 and # 4 were processed at the plant and had the following characteristics: Direct material cost por job (#3, #4): $ 9,700, $ 59,900 . Direct manufac. cost por jdb (#3, #4) $750, $11,250 Number of direct manufacturing Labor hours par job (#3, #4): 25, 375 Tosted units par job (#3, #4): 10, Parts por job (#3, #4): 500 The manufacturing cost por tested unit for job # 3 is 200 2,000 Q2 (2) Using simple costing, the manufacturing cost per tasted unit for job # 4 is- Q2 (4): The manufacturing cost per unit for job # 4 is- Q2 (5): Comparing the cost per unit between simple costing and ABC costing, job order # 4 has an in reported unit cost (simple costing) of - increase/decrease % Q2 (3): Givon the following information: Activity area Cost-allocation bass Materials handling parto Latho work kathic turds Milling Maching hours Grinding Parte - Tasting JADIER FORTRES Givon the jobs characteristlos bosed on ABC parti Parts purjob (#3, #4 600 . Cast Allocation rate $04 02 Materials handling parts . Lathe work lathe turns . Milling Machine-hours Grinding Parts Testing. units tosted Given the jobs characteristics based on ABC costing Parts per job (#3, #4): 500 2,000 Lathe turns por job (#3, #4): 20,000 60,000 150 1050 Machino-hours per job (#3, #4): Units tostod por job (#3, #4): 10 200 The indirect manufacturing cost por tostod unit in job #3 $0.4 0.2 20 0.8 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts