Question: cost accounting question 21 Sed Help Save & Ext Submit Markham Company makes two products: Basic Product and Deluxe Product Annual production and sales are

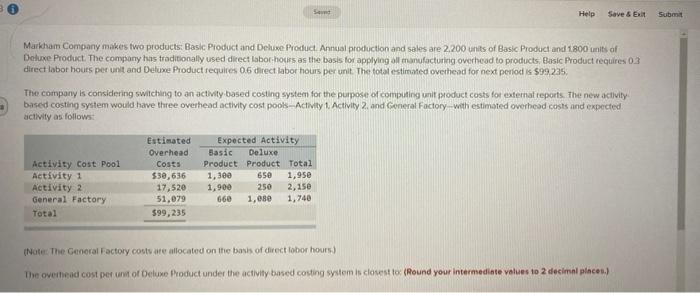

Sed Help Save & Ext Submit Markham Company makes two products: Basic Product and Deluxe Product Annual production and sales are 2.200 units of Basic Product and 1800 units of Deluxe Product. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products Basic Product requires 03 direct labor hours per unit and Deluxe Product requires 06 direct labor hours per unit. The total estimated overhead for next period is 599 235 The company is considering switching to an activity based costing system for the purpose of computing unit product costs for external reports the new activity based costing system would have three overhead activity cost pook Activity 1. Activity 2. and General Factory with estimated overhead costs and expected activity as follows: Activity Cost Pool Activity 1 Activity 2 General Factory Total Estimated Overhead Costs $38,636 17,520 51,079 599,235 Expected Activity Basic Deluxe Product Product Total 1,300 650 1.95e 1,900 250 2,150 660 1,080 1,740 (Note: The General Factory costs are allocated on the basis of direct lobor hours) The overhead cost per uw of Deluxe Product under the activity based costing system is closest to (Round your intermediate values to 2 decimal places) Seve Help Save & Exit (Note: The General Factory costs are allocated on the basis of direct labor hours.) The overhead cost per unit of Deluxe Product under the activity-based costing system is closest to (Round your intermediate values to 2 decimal places.) Multiple Choice $1761 $2442 $2329 $46.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts