Question: cost accounting question, please solve showing everything Q6 (a): A manufacturer has two departments; knitting and finishing. This question focuses on finishing department. Direct materials

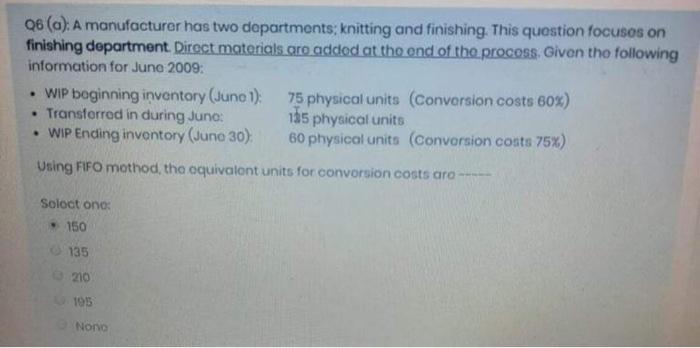

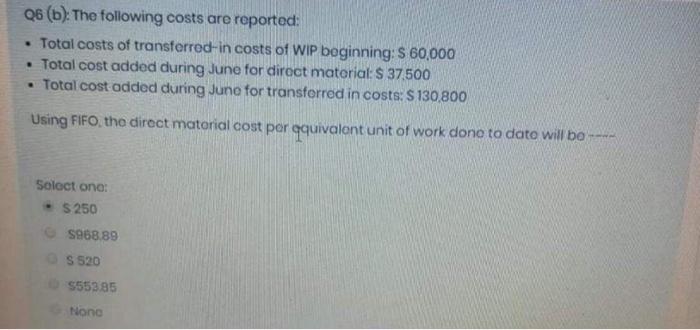

Q6 (a): A manufacturer has two departments; knitting and finishing. This question focuses on finishing department. Direct materials are added at the end of the process. Given the following information for June 2009: .WIP beginning inventory (June 1): Transferred in during Juno: WIP Ending inventory (June 30) 75 physical units (Conversion costs 60x) 135 physical units 60 physical units (conversion costs 75%) Using FIFO mothod, the equivalent units for convorsion costs aro----- Soloct one: - 150 135 210 195 Nono Q6 (b): The following costs are reported: Total costs of transferred-in costs of WIP beginning: $ 60,000 Total cost added during June for direct material: $ 37.500 Total cost added during June for transferred in costs: $ 130,800 Using FIFO, the direct material cost per qquivalent unit of work done to date will be Select one: -$250 $968.89 S 520 $553.85 Nono

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts