Question: Cost and inventory data for Harley Cycles is reported below. Identify the direct, overhead and non-manufacturing costs incurred by Harley Cycles. Calculate the cost of

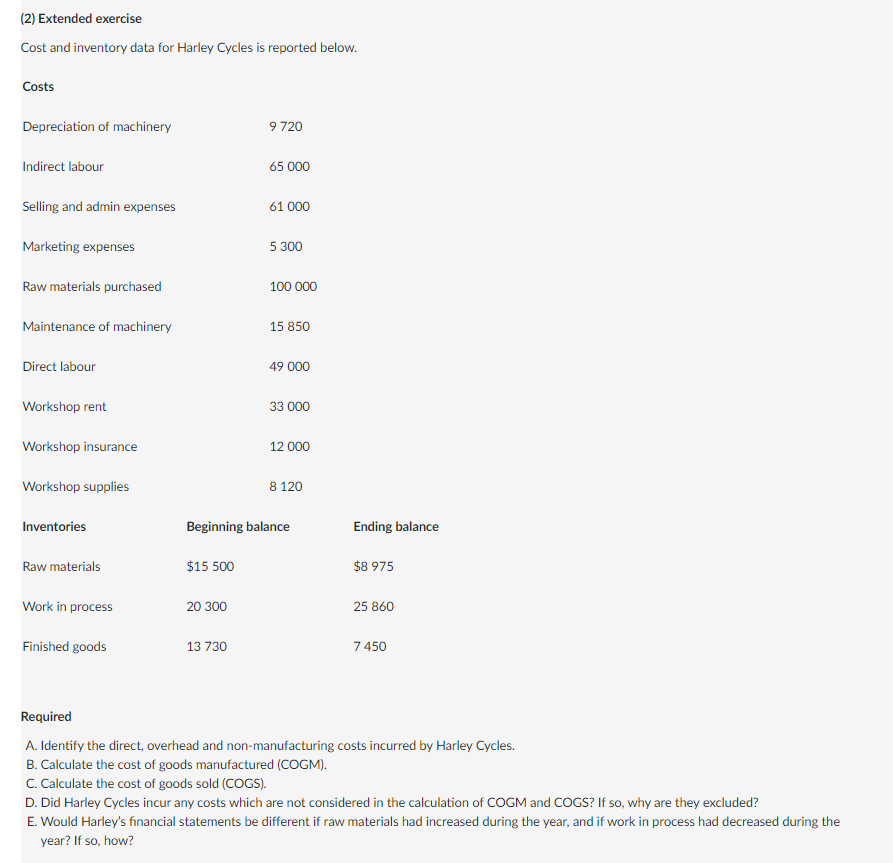

Cost and inventory data for Harley Cycles is reported below.

- Identify the direct, overhead and non-manufacturing costs incurred by Harley Cycles.

- Calculate the cost of goods manufactured (COGM).

- Calculate the cost of goods sold (COGS).

- Did Harley Cycles incur any costs which are not considered in the calculation of COGM and COGS? If so, why are they excluded?

- Would Harleys financial statements be different if raw materials had increased during the year, and if work in process had decreased during the year? If so, how?

(2) Extended exercise Cost and inventory data for Harley Cycles is reported below. Costs Depreciation of machinery 9720 Indirect labour 65 000 Selling and admin expenses 61 000 Marketing expenses 5300 Raw materials purchased 100 000 Maintenance of machinery 15 850 Direct labour 49 000 Workshop rent 33 000 Workshop insurance 12 000 Workshop supplies 8 120 Inventories Beginning balance Ending balance Raw materials $15 500 $8 975 Work in process 20 300 25 860 Finished goods 13 730 7450 Required A. Identify the direct, overhead and non-manufacturing costs incurred by Harley Cycles. B. Calculate the cost of goods manufactured (COGM). C. Calculate the cost of goods sold (COGS). D. Did Harley Cycles incur any costs which are not considered in the calculation of COGM and COGS? If so, why are they excluded? E. Would Harley's financial statements be different if raw materials had increased during the year, and if work in process had decreased during the year? If so, how

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts