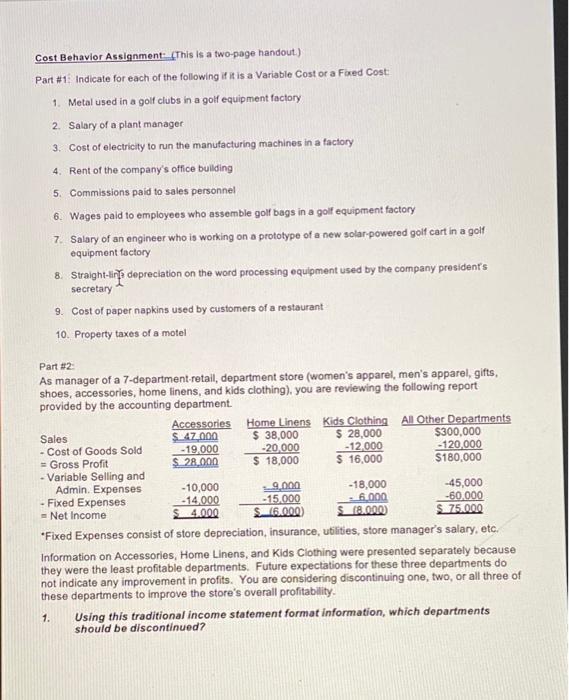

Question: Cost Behavior Assignment. This is a two-page handout.) Part #1: Indicate for each of the following if it is a Variable Cost or a Foxed

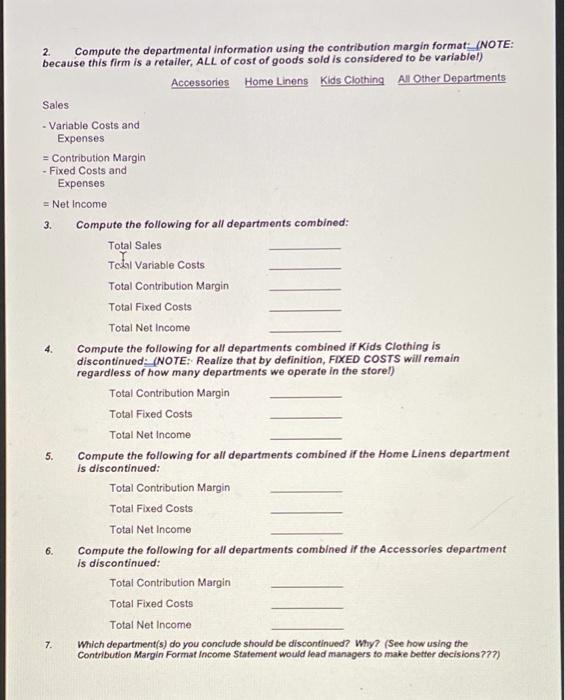

Cost Behavior Assignment. This is a two-page handout.) Part #1: Indicate for each of the following if it is a Variable Cost or a Foxed Cost 1. Metal used in a golf clubs in a golf equipment factory 2. Salary of a plant manager 3. Cost of electricity to run the manufacturing machines in a factory 4. Rent of the company's office building 5. Commissions paid to sales personnel 6. Wages paid to employees who assemble golf bags in a golf equipment factory 7. Salary of an engineer who is working on a prototype of a new solar powered golf cart in a golf equipment factory 8. Straight-inti depreciation on the word processing equipment used by the company president's Secretary 9. Cost of paper napkins used by customers of a restaurant 10. Property taxes of a motel Part #2: As manager of a 7-department-retail, department store (women's apparel, men's apparel, gifts, shoes, accessories, home linens, and kids clothing), you are reviewing the following report provided by the accounting department. Accessories Home Linens Kids Clothing All Other Departments Sales $147.000 $ 38,000 $ 28,000 $300,000 - Cost of Goods Sold -19.000 -20.000 - 12 000 -120,000 = Gross Profit $ 28,000 $ 18,000 $ 16,000 $180.000 - Variable Selling and Admin. Expenses - 10,000 9.000 -18,000 -45,000 - Fixed Expenses -14.000 - 15.000 - 6.000 -60.000 = Net Income 4.000 $_16.000 $18.000) $ 75.000 *Fixed Expenses consist of store depreciation, insurance, utilities, store manager's salary, etc. Information on Accessories, Home Linens, and Kids Clothing were presented separately because they were the least profitable departments. Future expectations for these three departments do not indicate any improvement in profits. You are considering discontinuing one, two, or all three of these departments to improve the store's overall profitability Using this traditional income statement format information, which departments should be discontinued? 1. 2 3. Compute the departmental information using the contribution margin format: (NOTE: because this firm is a retailer, ALL of cost of goods sold is considered to be variable!) Accessories Home Linens Kids Clothing All Other Departments Sales - Variable costs and Expenses = Contribution Margin - Fixed Costs and Expenses = Net Income Computo the following for all departments combined: Total Sales Tchi Variable Costs Total Contribution Margin Total Fixed Costs Total Net Income Compute the following for all departments combined if Kids Clothing is discontinued:_(NOTE: Realize that by definition, FIXED COSTS will remain regardless of how many departments we operate in the store!) Total Contribution Margin Total Fixed Costs Total Net Income 5. Compute the following for all departments combined if the Home Linens department is discontinued: Total Contribution Margin Total Fixed Costs Total Net Income Compute the following for all departments combined if the Accessories department is discontinued: Total Contribution Margin Total Fixed Costs Total Not Income Which department(s) do you conclude should be discontinued? Why? (See how using the Contribution Margin Format Income Statement would lead managers to make better decisions777) 4. 6. 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts