Question: Cost Classification (Assignment #1) Her first action plan was to list all the key products or items that she would need to start the business.

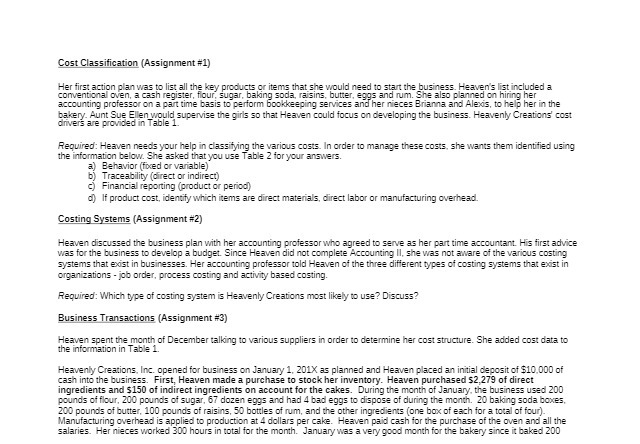

Cost Classification (Assignment #1) Her first action plan was to list all the key products or items that she would need to start the business. Heaven's list included a conventional oven, a cash register, flour, sugar, baking soda, raisins, butter, eggs and rum. She also planned on hiring her accounting professor on a part time basis to perform bookkeeping services and her nieces Brianna and Alexis, to help her in the bakery. Aunt Sue Ellen would supervise the girls so that Heaven could focus on developing the business. Heavenly Creations' cost drivers are provided in Table 1. Required: Heaven needs your help in classifying the various costs. In order to manage these costs, she wants them identified using the information below. She asked that you use Table 2 for your answers. 3) Behavior (fixed or variable) Traceability (direct or indirect) Financial reporting (product or period) d) If product cost, identify which items are direct materials, direct labor or manufacturing overhead. Costing Systems (Assignment #2) Heaven discussed the business plan with her accounting professor who agreed to serve as her part time accountant. His first advice was for the business to develop a budget. Since Heaven did not complete Accounting II, she was not aware of the various costing systems that exist in businesses. Her accounting professor told Heaven of the three different types of costing systems that exist in organizations - job order, process costing and activity based costing. Required: Which type of costing system is Heavenly Creations most likely to use? Discuss? Business Transactions (Assignment #3) Heaven spent the month of December talking to various suppliers in order to determine her cost structure. She added cost data to the information in Table 1. Heavenly Creations, Inc. opened for business on January 1, 201X as planned and Heaven placed an initial deposit of $10.000 of cash into the business. First, Heaven made a purchase to stock her inventory. Heaven purchased $2,279 of direct ingredients and $150 of indirect ingredients on account for the cakes. During the month of January, the business used 200 pounds of flour, 200 pounds of sugar, 67 dozen eggs and had 4 bad eggs to dispose of during the month. 20 baking soda boxes, 200 pounds of butter, 100 pounds of raisins, 50 bottles of rum, and the other ingredients (one box of each for a total of four). Manufacturing overhead is applied to production at 4 dollars per cake. Heaven paid cash for the purchase of the oven and all the salaries. Her nieces worked 300 hours in total for the month. January was a very good month for the bakery since it baked 200