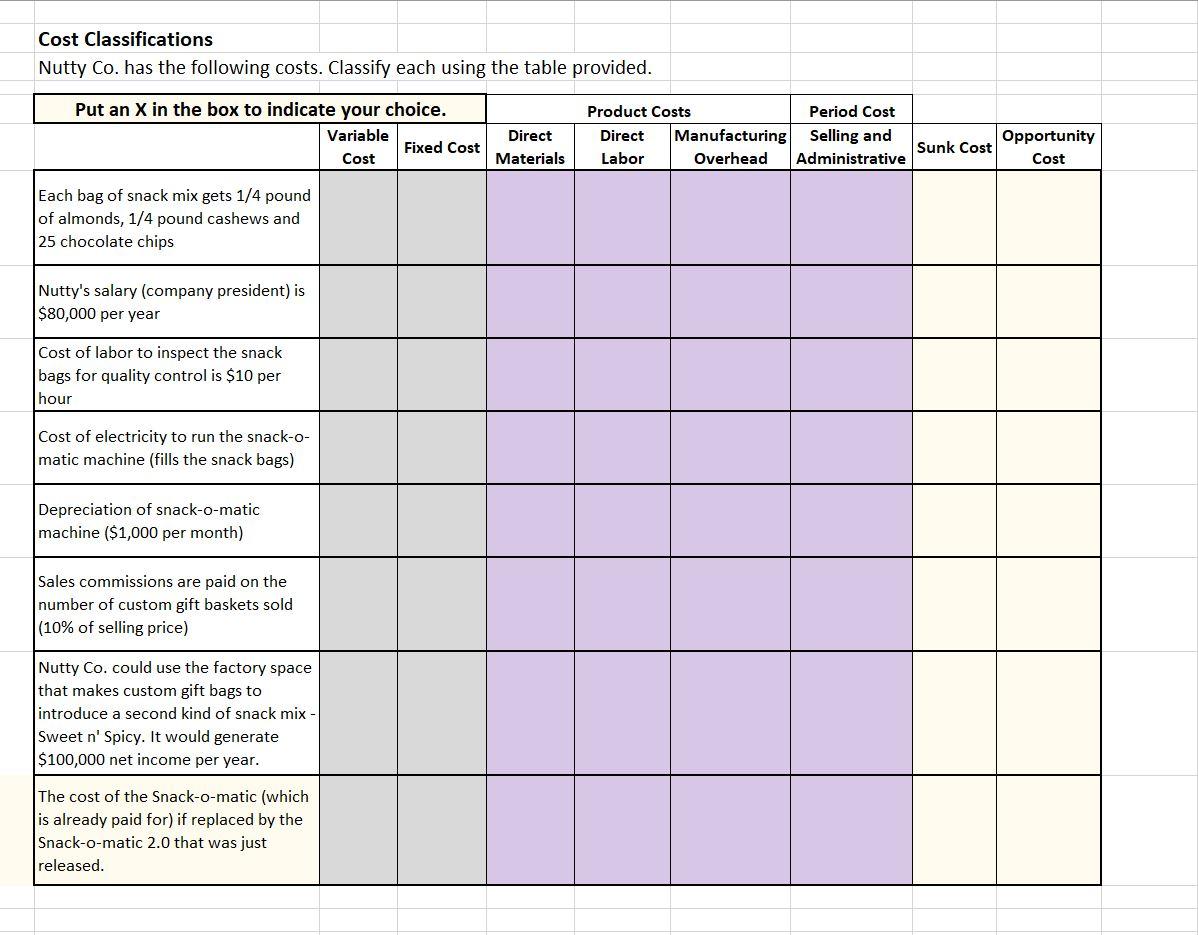

Question: Cost Classifications Nutty Co. has the following costs. Classify each using the table provided. Put an X in the box to indicate your choice. Variable

Cost Classifications Nutty Co. has the following costs. Classify each using the table provided. Put an X in the box to indicate your choice. Variable Fixed Cost Cost Direct Materials Product Costs Direct Manufacturing Labor Overhead Period Cost Selling and Administrative Sunk Cost Opportunity Cost Each bag of snack mix gets 1/4 pound of almonds, 1/4 pound cashews and 25 chocolate chips Nutty's salary (company president) is $80,000 per year Cost of labor to inspect the snack bags for quality control is $10 per hour Cost of electricity to run the snack-o- matic machine (fills the snack bags) Depreciation of snack-o-matic machine ($1,000 per month) Sales commissions are paid on the number of custom gift baskets sold (10% of selling price) Nutty Co. could use the factory space that makes custom gift bags to introduce a second kind of snack mix Sweet n' Spicy. It would generate $100,000 net income per year. The cost of the Snack-o-matic (which is already paid for) if replaced by the Snack-o-matic 2.0 that was just released

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts