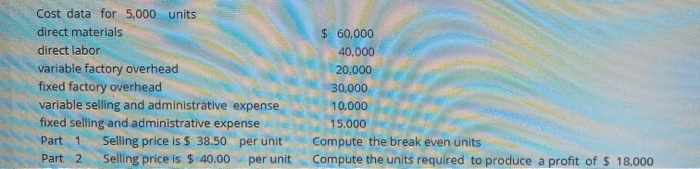

Question: Cost data for 5,000 units direct materials direct labor variable factory overhead fixed factory overhead variable selling and administrative expense fixed selling and administrative expense

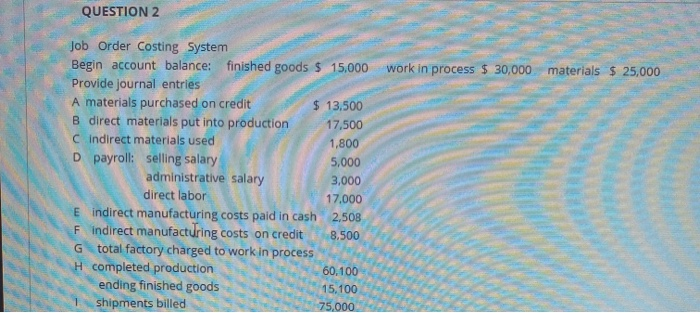

Cost data for 5,000 units direct materials direct labor variable factory overhead fixed factory overhead variable selling and administrative expense fixed selling and administrative expense Part 1 Selling price is $ 38.50 per unit Part 2 Selling price is $ 40.00 $ 60,000 40,000 20,000 30,000 10,000 15.000 Compute the break even units Compute the units required to produce a profit of $ 18,000 per unit QUESTION 2 work in process $ 30,000 materials $ 25,000 Job Order Costing System Begin account balance: finished goods $ 15.000 Provide journal entries A materials purchased on credit $ 13,500 B direct materials put into production 17.500 Cindirect materials used 1,800 D payroll: selling salary 5,000 administrative salary 3,000 direct labor 17.000 E indirect manufacturing costs paid in cash 2,508 F indirect manufacturing costs on credit 8.500 G total factory charged to work in process H completed production 60,100 ending finished goods 15.100 shipments billed 75.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts