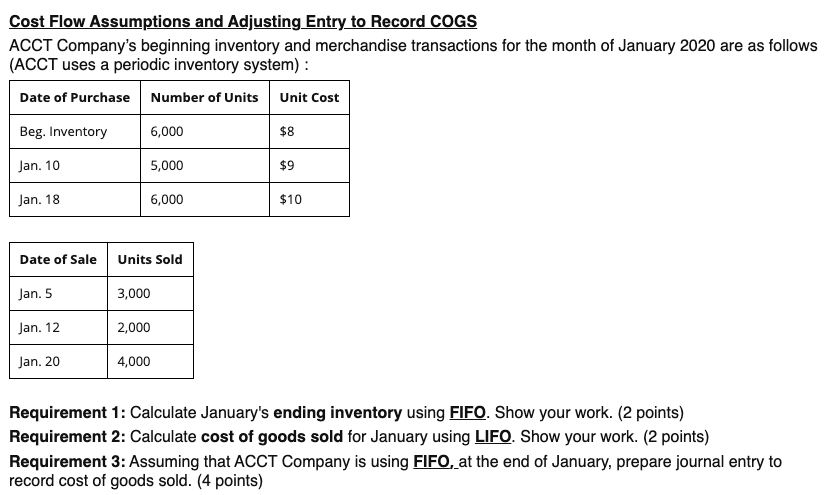

Question: Cost Flow Assumptions and Adjusting Entry to Record COGS ACCT Company's beginning inventory and merchandise transactions for the month of January 2020 are as follows

Cost Flow Assumptions and Adjusting Entry to Record COGS ACCT Company's beginning inventory and merchandise transactions for the month of January 2020 are as follows (ACCT uses a periodic inventory system): Date of Purchase Number of Units Unit Cost Beg. Inventory 6,000 $8 Jan. 10 5,000 $9 Jan. 18 6,000 $10 Date of Sale Units Sold Jan. 5 3,000 Jan. 12 2,000 Jan. 20 4,000 Requirement 1: Calculate January's ending inventory using FIFO. Show your work. (2 points) Requirement 2: Calculate cost of goods sold for January using LIFO. Show your work. (2 points) Requirement 3: Assuming that ACCT Company is using FIFO, at the end of January, prepare journal entry to record cost of goods sold. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts