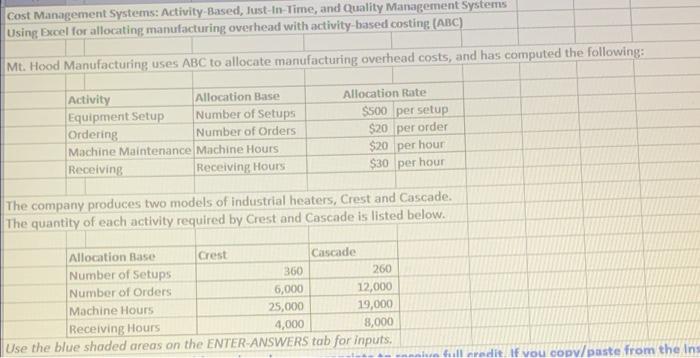

Question: Cost Management Systems: Activity-Based, Just-In-Time, and Quality Management Systems Using Excel for allocating manufacturing overhead with activity-based costing (ABC) Mt. Hood Manufacturing uses ABC to

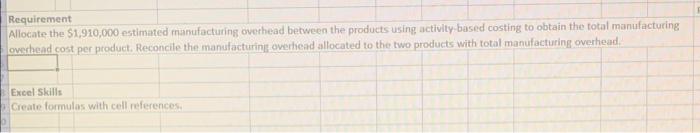

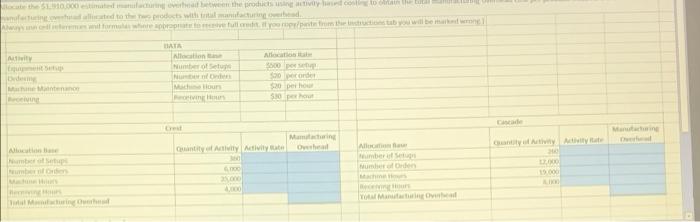

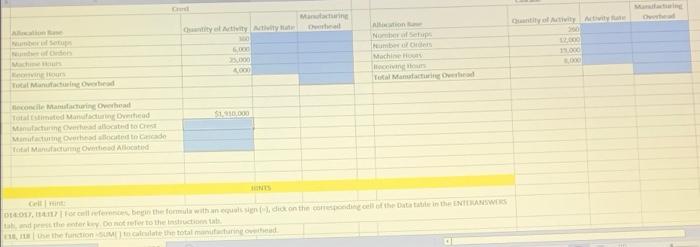

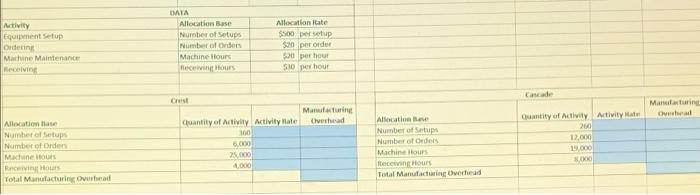

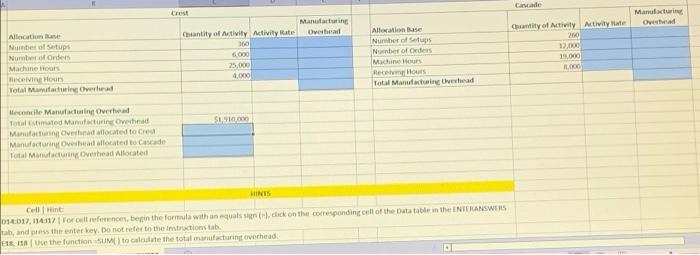

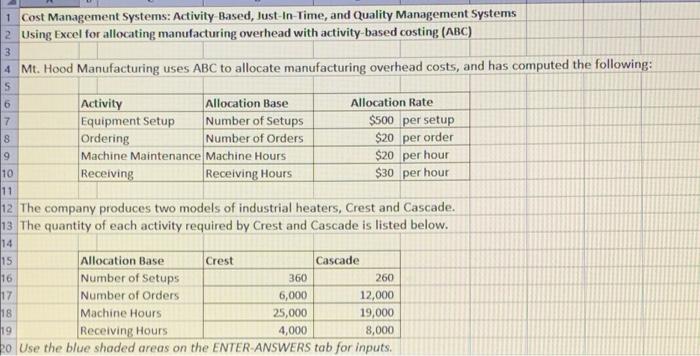

Cost Management Systems: Activity Based, Just-in-Time, and Quality Management Systems Using Excel for allocating manufacturing overhead with activity-based costing (ABC) Mt. Hood Manufacturing uses ABC to allocate manufacturing overhead costs, and has computed the following: Activity Allocation Base Equipment Setup Number of Setups Ordering Number of Orders Machine Maintenance Machine Hours Receiving Receiving Hours Allocation Rate $500 per setup $20 per order $20 per hour $30 per hour The company produces two models of industrial heaters, Crest and Cascade The quantity of each activity required by Crest and Cascade is listed below. Allocation Base Crest Cascade Number of Setups 360 260 Number of Orders 6,000 12,000 Machine Hours 25,000 19,000 Receiving Hours 4,000 8,000 Use the blue shaded areas on the ENTER-ANSWERS tab for inputs. All credit If You Copy/paste from the Ins Requirement Allocate the 51,910,000 estimated manufacturing overhead between the products using activity based costing to obtain the total manufacturing overhead cost per product. Reconcile the manufacturing overhead allocated to the two products with total manufacturing overhead, Excel Skills Create formulas with cell references 10.000 metre the provincolo mated to the wild multi yorumlab you will be mame Activity TATA Allein Nutto NO ton Dede All 00 Second $20 per hou SHOP Marine Othe Gminy Activity Al Member um den 200 umber umber MO Mandarin . 10 100 Noup (reumber of orden Machine How Hoci Y Manted Total Mind $1100 econcile Marine Orad Tutamated Dead Minulaadated to rest Minum Outlet to do Tot Manufacture of Allocated DOL, the form with custodick on the concello the Date in the ENSWERS and try to the the the function at the total Activity Egent Setup Order Machine Maintenance Receiving DATA Allocation Base Number of Setups Number of Order Machine Hours Allocation Rate $500 persetup $20 per order 20 per hour S10 per hour Crest Manuri Overhead Manufacturing ca Allocation de Number of Setup Number of Orden Machines Ho Total Manufacturing Over Quantity of Activity Activity Mate 100 6.000 2000 1.000 Altin Number of Setups Number of Od Machine Hours Receiving Hours Total Manufacturing Overhead Quantity of Activity Activity 200 12.000 19.000 000 Cavade Manufacturing Over Manufacture Owad Altun Number of ups Number of onders Machine for VIHU Total Manufacturing Optima Cantity of Ativity Activity Rate 100 000 25,000 4,000 Alicana Number of sus Number of Order Machines Rece Hours Total Manufacturing whead Guantity of Activity Activitate 200 13.00 100D 51 Mecane Manufacturing Overhead Totestimated Manufacturing Cread Man Ove located to C Manufacturing Overad allocated to a de Total Manufacturin Overhead Allocated HINES Cellit 094017.114:17 Forcellence, begin the formula with an equals click on the corresponding all of the Datatable in the ENTERANSWERS rab, and press the enter key. Do not refer to the instructions tab FRI U the function.SUM tocate the total manufacturint overhead 1 Cost Management Systems: Activity Based, Just-In-Time, and Quality Management Systems 2. Using Excel for allocating manufacturing overhead with activity-based costing (ABC) 3 7 8 4 Mt. Hood Manufacturing uses ABC to allocate manufacturing overhead costs, and has computed the following: S 6 Activity Allocation Base Allocation Rate Equipment Setup Number of Setups $500 per setup Ordering Number of Orders $20 per order 9 Machine Maintenance Machine Hours $20 per hour 10 Receiving Receiving Hours $30 per hour 11 12 The company produces two models of industrial heaters, Crest and Cascade. 13 The quantity of each activity required by Crest and Cascade is listed below. 14 15 Allocation Base Crest Cascade Number of Setups 360 260 17 Number of Orders 6,000 12,000 18 Machine Hours 25,000 19,000 Receiving Hours 4,000 8,000 ko Use the blue shaded areas on the ENTER-ANSWERS tab for inputs. 16 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts