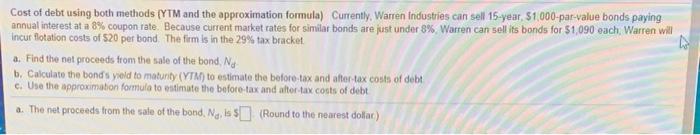

Question: Cost of debt using both methods (YTM and the approximation formula) Currently, Warren Industries can sell 15-year, 51,000-par-value bonds paying annual interest at a 8%

Cost of debt using both methods (YTM and the approximation formula) Currently, Warren Industries can sell 15-year, 51,000-par-value bonds paying annual interest at a 8% coupon rate. Because current market rates for similar bonds are just under 8% Warren can sell its bonds for 51,090 each Warren will Incut flotation costs of S20 per bond. The firm is in the 29% tax bracket a. Find the net proceeds from the sale of the bond. Nd b. Calculate the bond's yield to maturity (TM) to estimate the before-tax and after tax costs of debt c. Use the approximation formula to estimate the before-tax and after tax costs of debt a. The net proceeds from the sale of the band. No. (Round to the nearest dolar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts