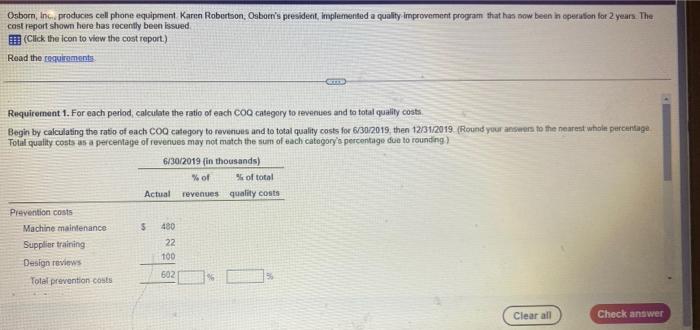

Question: cost report shown here has recenthy been issued (Click the icon to vierw the cost report.) Read the requirnments. Requirement 1. For each periad, calcilate

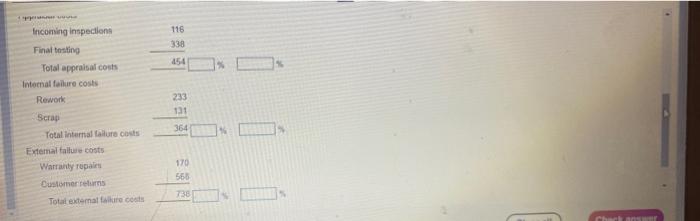

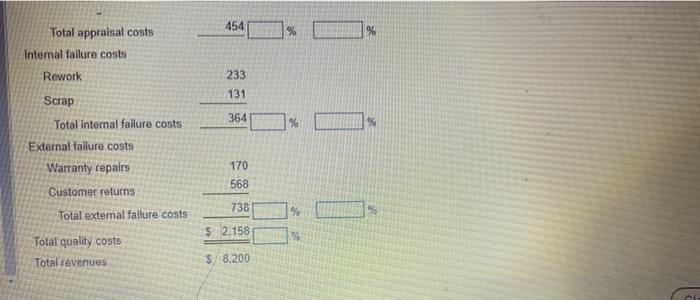

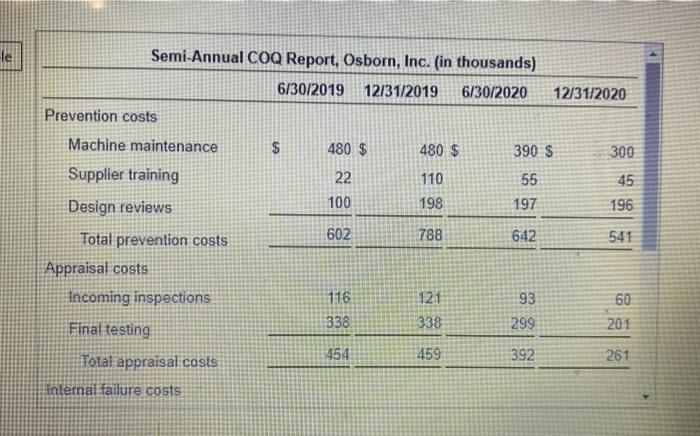

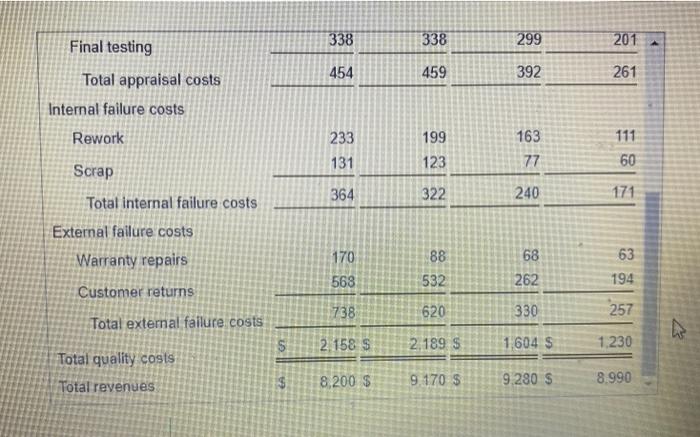

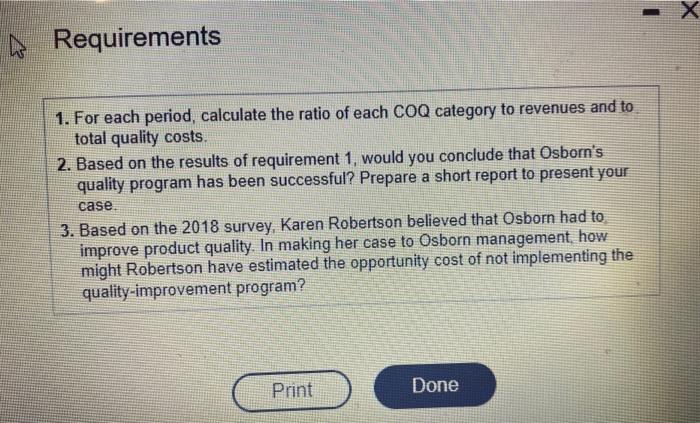

cost report shown here has recenthy been issued (Click the icon to vierw the cost report.) Read the requirnments. Requirement 1. For each periad, calcilate the ratio of each COQ category to tevenues and to total quality costs: Begin by calculating the ratio of each COQ category to revenuis and to total quality costs for 6/302019, then 12i31/2019. (Round your answers to the nearent whale percertage Tolal quality costs as a percentage of revenues may not match the sian of each catogory's percentage due to rounding) \begin{tabular}{ll} Incoming inspectlons & 116 \\ Final tosting & 338 \\ Total appraisal cons & 454 \\ \hline \end{tabular} Intemal fainure costs Extemai talluse costs Wartahty repaim \begin{tabular}{l} 170 \\ 560 \\ \hline 736 \\ \hline \end{tabular} Total appraisal costs 4454% Intemal fallure costs External failure costs \begin{tabular}{lc} Warranty repairs & 170 \\ Customer returns & 568 \\ \cline { 2 } Total extemal fallure costs & 738 \\ \cline { 2 } Total quality costs & 2,158 \\ Total revenues & $58.200 \end{tabular} Internal failure costs Requirements 1. For each period, calculate the ratio of each COQ category to revenues and to total quality costs. 2. Based on the results of requirement 1 , would you conclude that Osborn's quality program has been successful? Prepare a short report to present your case. 3. Based on the 2018 survey, Karen Robertson believed that Osborn had to improve product quality. In making her case to Osborn management, how might Robertson have estimated the opportunity cost of not implementing the quality-improvement program

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts