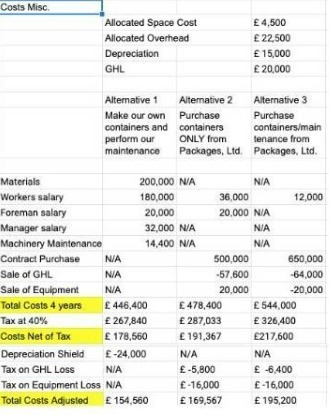

Question: Costa Misc. Allocated Space Cost E 4.500 Allocated Overhead E 22.500 Depreciation E 15,000 GHL E 20,000 Alternative 1 Alternative 2 Alternative 3 Make our

Costa Misc. Allocated Space Cost E 4.500 Allocated Overhead E 22.500 Depreciation E 15,000 GHL E 20,000 Alternative 1 Alternative 2 Alternative 3 Make our own Purchase Purchase containers and containers containers/main perform our ONLY from tenance from maintonanco Packages, Lid. Packages, Ltd. Materials 200,000 N/A NIA Workers salary 180,000 36.000 12.000 Foreman salary 20,000 20.000 NIA Manager salary 32,000 N/A NA Machinery Maintenance 14,400 N/A NIA Contract Purchase NIA 500.000 650.000 Sale of GHL NIA -57.600 -64,000 Sale of Equipment NIA 20.000 20,000 Total Costs 4 years E 446,400 E 478,400 E 544,000 Tax at 40% E 267,840 E 287,033 E 326,400 Costs Net of Tax E 178,560 E 191.367 E217.600 Depreciation Shield E-24.000 N/A N/A Tax on GHL Loss N/A E-5,800 E -6.400 Tax on Equipment Loss NIA C-16,000 E-16,000 Total Costs Adjusted E 154,560 E 169.567 E 195,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts