Question: Costing inventory when using the periodic inventory process Please answer the question by using word or excel Costing Inventory when using the Periodic Inventory Process

Costing inventory when using the periodic inventory process

Please answer the question by using word or excel

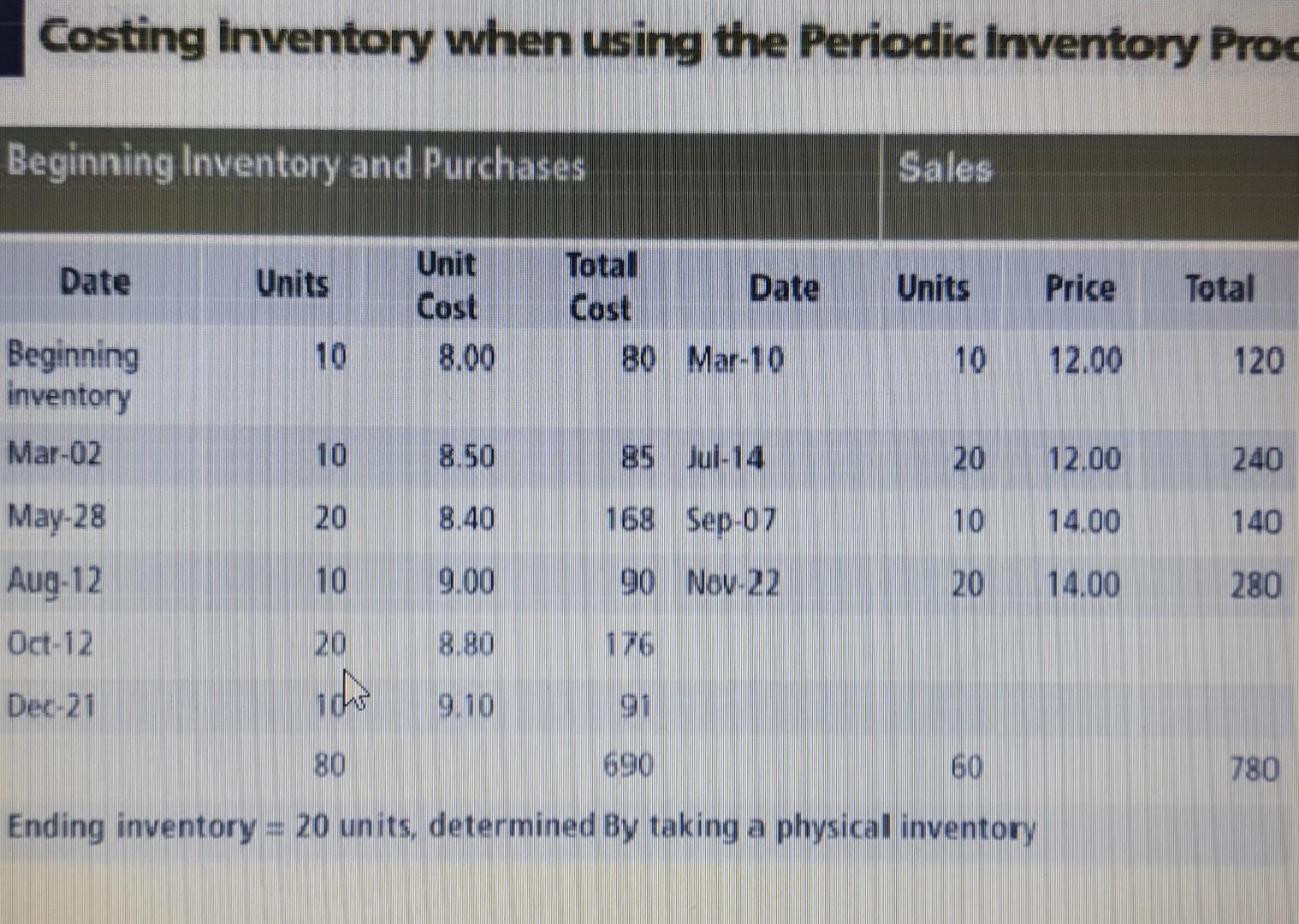

Costing Inventory when using the Periodic Inventory Process Using the data for purchases, sales, and beginning inventory in Exhibit 49, next we explain the four inventory costing methods. Except for the specific identification method, we first present all of the methods using periodic inventory procedure and then present all of the methods using perpetual inventory procedure. 1. Total goods available for sale consist of 80 units with a total cost of $690. 2. A physical inventory determined that 20 units are on hand at the end of the period. 3. Sales revenue for the 60 units soid was $780. The questions to be answered are: 1. What is the cost of the 20 units in inventory? 2. What is the cost of the 60 units sold? Costing Inventory when using the Periodic Inventory Prod Beginning Inventory and Purchases Sales Date Units Units Price Total Unit Cost 8.00 Total Date Cost 80 Mar-10 10 10 12.00 120 Beginning inventory Mar-02 10 8.50 85 Jul-14 20 12.00 240 May-28 20 8.40 168 Sep-07 10 14.00 140 Aug-12 10 9.00 90 Nov-22 20 14.00 280 Oct-12 20 8.80 176 Dec-21 91 80 690 60 780 Ending inventory = 20 units determined By taking a physical inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts