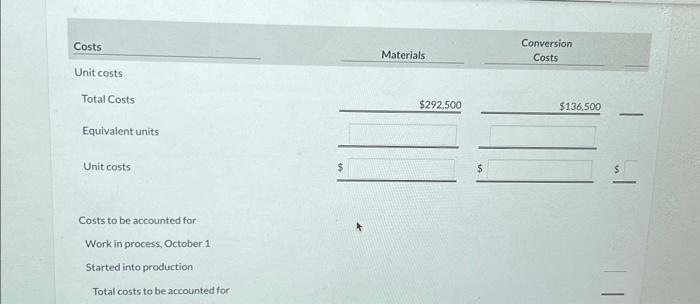

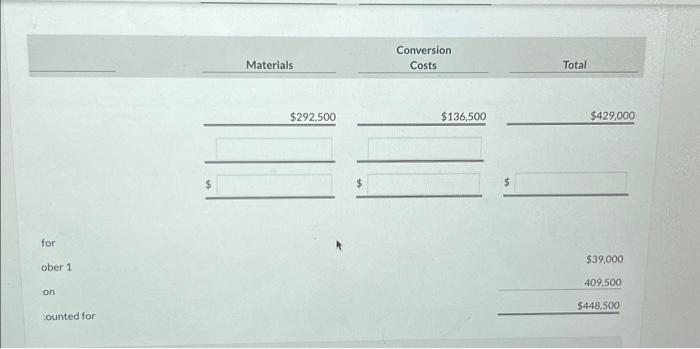

Question: Costs Materials Conversion Unit costs Costs Total Costs Unit costs $ $136,500 Equivalent units Unit costs Costs to be accounted for Work in process, October

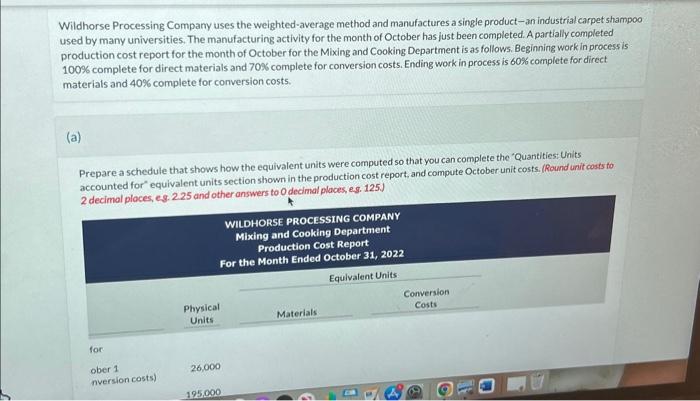

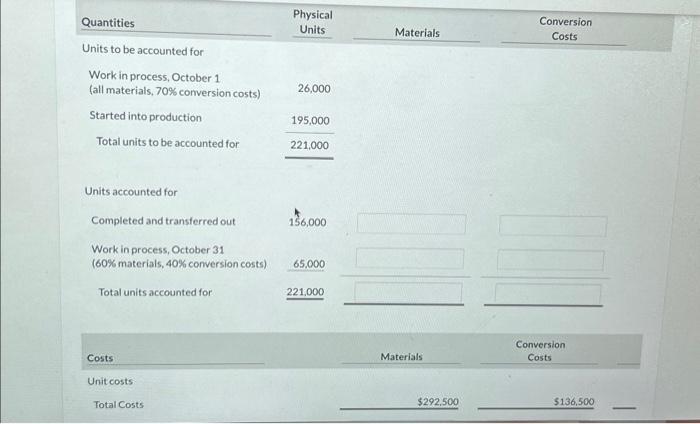

Costs Materials Conversion Unit costs Costs Total Costs Unit costs $ $136,500 Equivalent units Unit costs Costs to be accounted for Work in process, October 1 Started into production Total costs to be accounted for Wildhorse Processing Company uses the weighted-average method and manufactures a single product-an industrial carpet shampoo used by many universities. The manufacturing activity for the month of October has just been completed. A partialiy completed production cost report for the month of October for the Mixing and Cooking Department is as follows. Beginning work in process is 100% complete for direct materials and 70% complete for conversion costs. Ending work in process is 60% complete for direct materials and 40% complete for conversion costs. (a) Prepare a schedule that shows how the equivalent units were computed so that you can complete the 'Quantities: Units accounted for" equivalent units section shown in the production cost report, and compute October unit costs. (Round unit costs to 2 decimal places, es. 2.25 and other answers to 0 decimal places, e.s. 125.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts