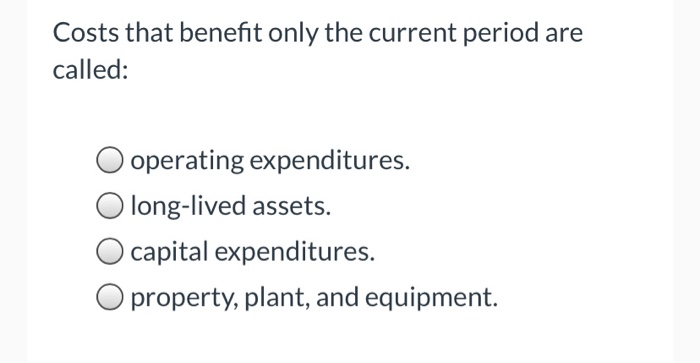

Question: Costs that benefit only the current period are called: operating expenditures. long-lived assets. capital expenditures. O property, plant, and equipment. The cost of equipment can

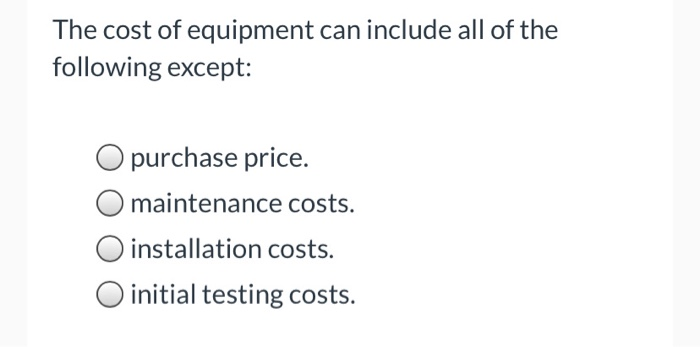

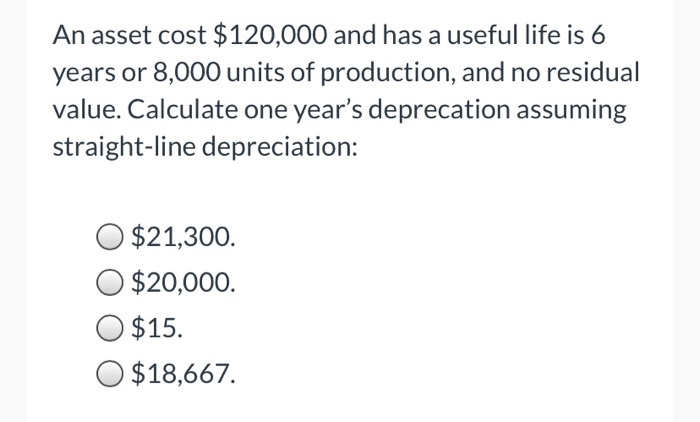

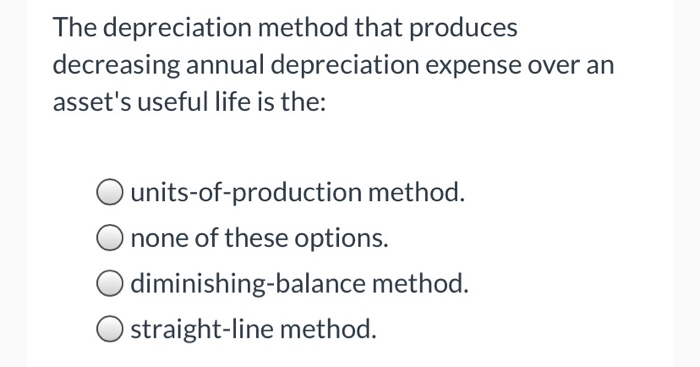

Costs that benefit only the current period are called: operating expenditures. long-lived assets. capital expenditures. O property, plant, and equipment. The cost of equipment can include all of the following except: O purchase price. maintenance costs. O installation costs. O initial testing costs. An asset cost $120,000 and has a useful life is 6 years or 8,000 units of production, and no residual value. Calculate one year's deprecation assuming straight-line depreciation: $21,300. $20,000. O $15. O $18,667. The depreciation method that produces decreasing annual depreciation expense over an asset's useful life is the: units-of-production method. none of these options. diminishing-balance method. O straight-line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts