Question: Cougar Company changed its inventory method from the average cost method to FIFO at the start of 2 0 2 4 . At December 3

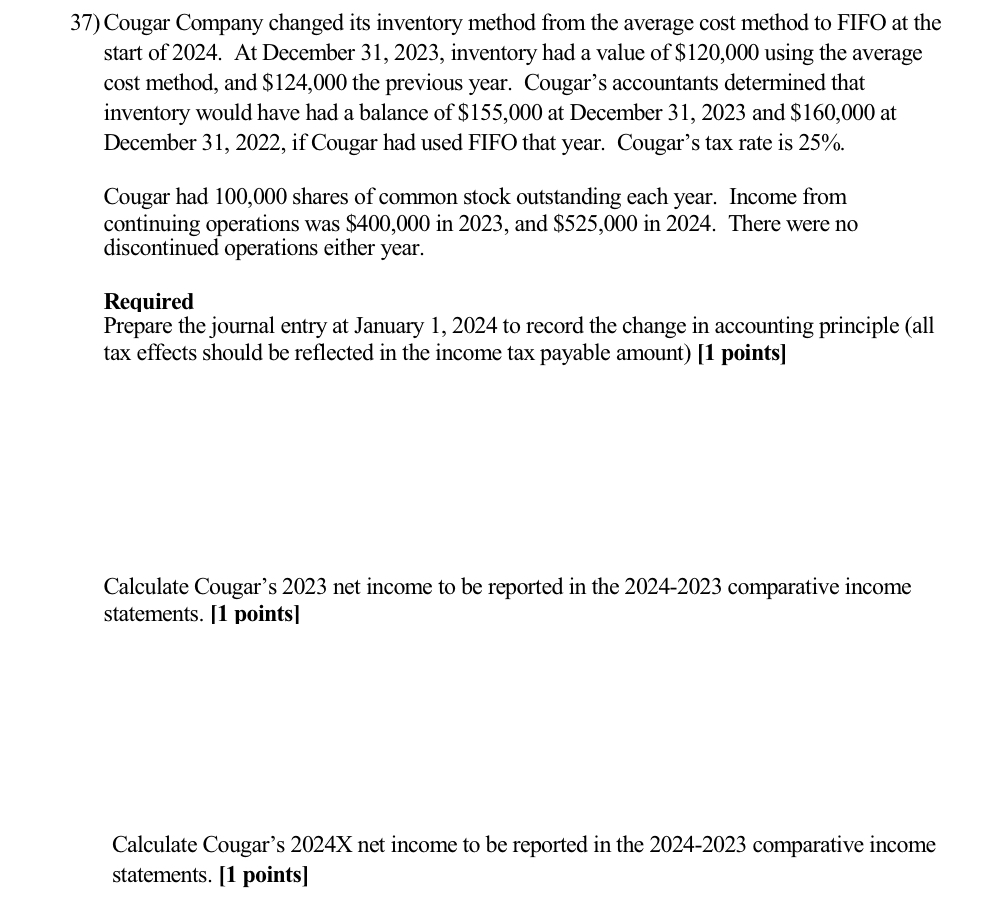

Cougar Company changed its inventory method from the average cost method to FIFO at the start of At December inventory had a value of $ using the average cost method, and $ the previous year. Cougar's accountants determined that inventory would have had a balance of $ at December and $ at December if Cougar had used FIFO that year. Cougar's tax rate is

Cougar had shares of common stock outstanding each year. Income from continuing operations was $ in and $ in There were no discontinued operations either year.

Required

Prepare the journal entry at January to record the change in accounting principle all tax effects should be reflected in the income tax payable amount points

Calculate Cougar's net income to be reported in the comparative income statements. points

Calculate Cougar's X net income to be reported in the comparative income statements. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock