Question: could anyone answer question 4 and 7. im confused on how to liquidate the partnership and especially question 7, journalizing the declaration of the cash

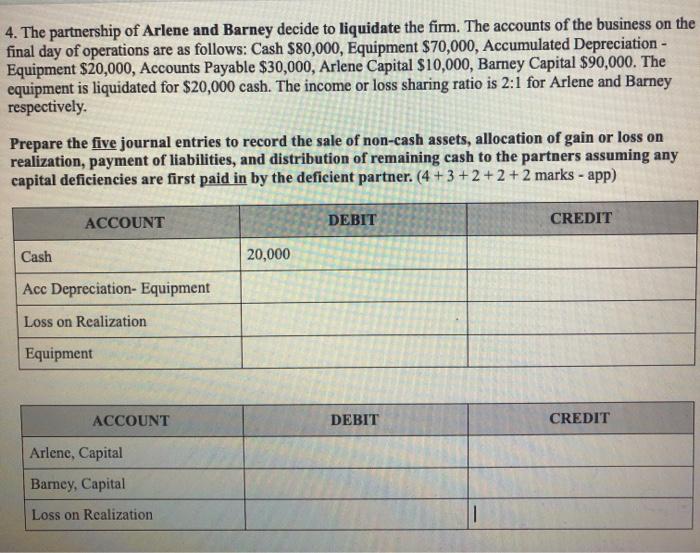

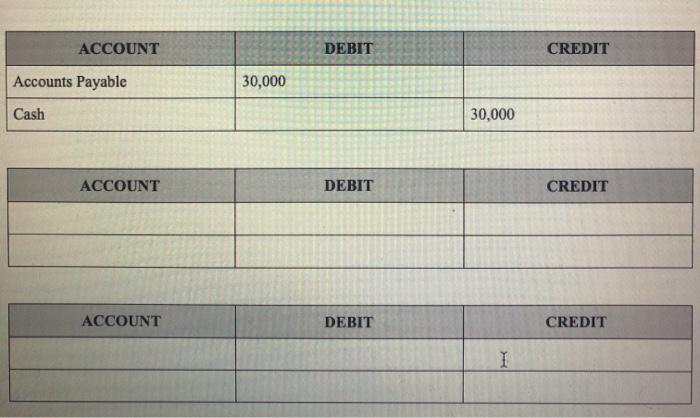

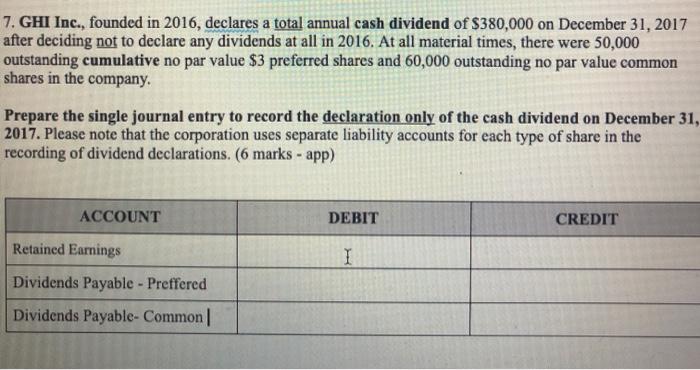

4. The partnership of Arlene and Barney decide to liquidate the firm. The accounts of the business on the final day of operations are as follows: Cash $80,000, Equipment $70,000, Accumulated Depreciation - Equipment $20,000, Accounts Payable $30,000, Arlene Capital $10,000, Barney Capital $90,000. The equipment is liquidated for $20,000 cash. The income or loss sharing ratio is 2:1 for Arlene and Barney respectively. Prepare the five journal entries to record the sale of non-cash assets, allocation of gain or loss on realization, payment of liabilities, and distribution of remaining cash to the partners assuming any capital deficiencies are first paid in by the deficient partner. (4+3 + 2 + 2 + 2 marks - app) ACCOUNT DEBIT CREDIT Cash 20,000 Acc Depreciation- Equipment Loss on Realization Equipment ACCOUNT DEBIT CREDIT Arlene, Capital Barney, Capital Loss on Realization 1 ACCOUNT DEBIT CREDIT Accounts Payable 30,000 Cash 30,000 ACCOUNT DEBIT CREDIT ACCOUNT DEBIT CREDIT I 7. GHI Inc., founded in 2016, declares a total annual cash dividend of $380,000 on December 31, 2017 after deciding not to declare any dividends at all in 2016. At all material times, there were 50,000 outstanding cumulative no par value $3 preferred shares and 60,000 outstanding no par value common shares in the company. Prepare the single journal entry to record the declaration only of the cash dividend on December 31, 2017. Please note that the corporation uses separate liability accounts for each type of share in the recording of dividend declarations. (6 marks - app) ACCOUNT DEBIT CREDIT Retained Earnings I Dividends Payable - Preffered Dividends Payable-Common

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts