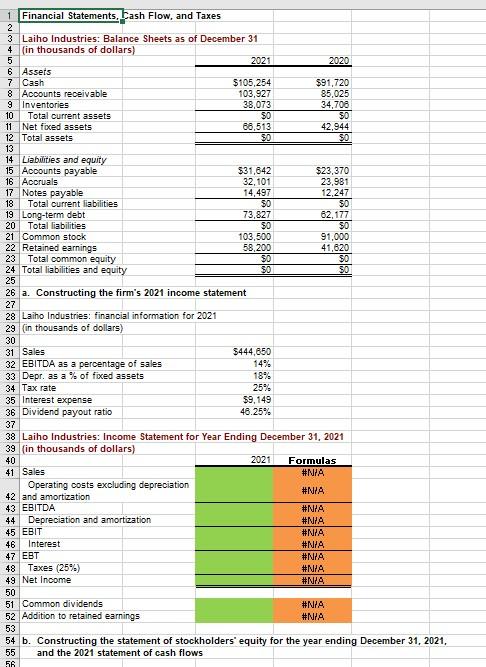

Question: Could anyone explain how to work through these problems? Thanks in advance. a. Constructing the firm's 2021 income statement Laiho Industries: financial information for 2021

Could anyone explain how to work through these problems? Thanks in advance.

Could anyone explain how to work through these problems? Thanks in advance.

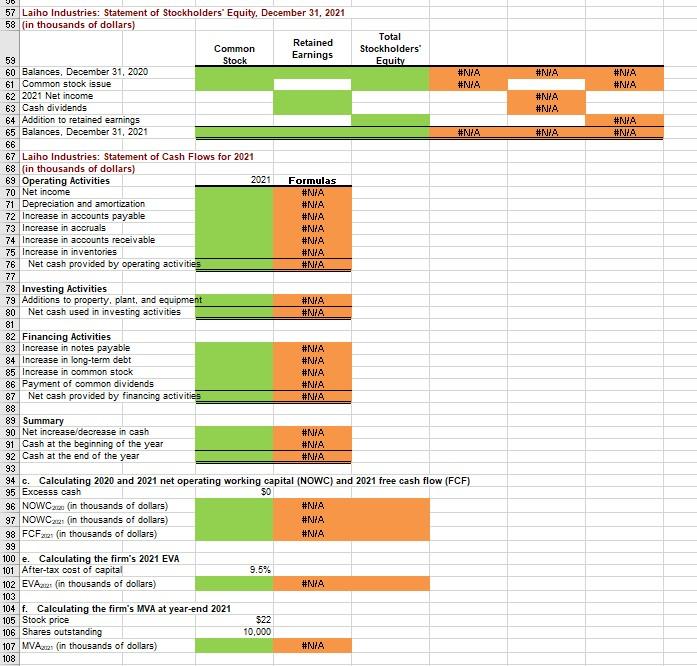

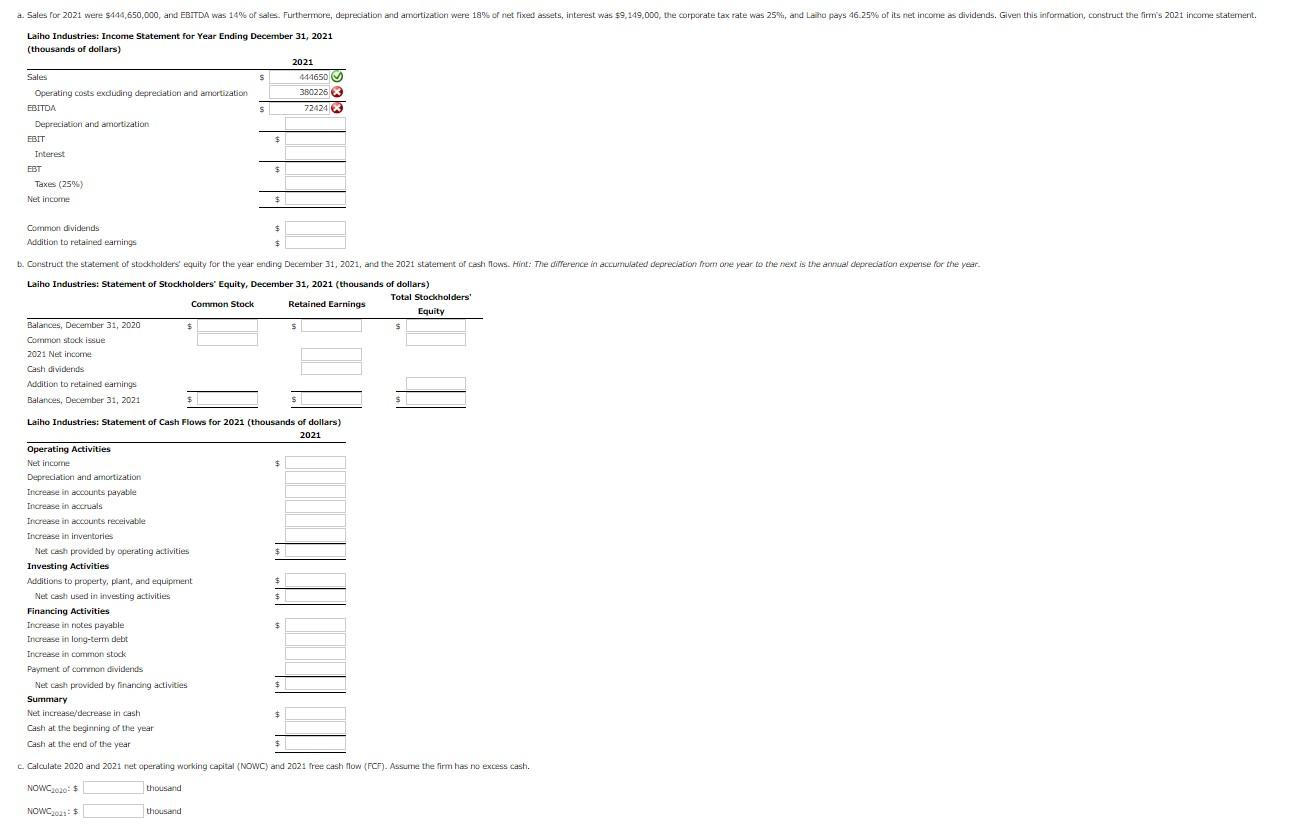

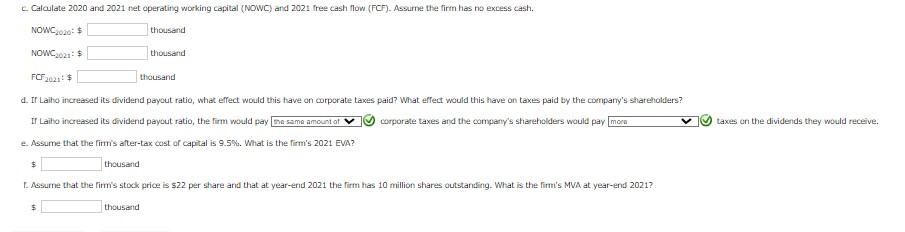

a. Constructing the firm's 2021 income statement Laiho Industries: financial information for 2021 (in thousands of dollars) \begin{tabular}{l|l|r} & \\ \hline 30 & Sales & $444,650 \\ 32 & EBITDA as a percentage of sales & 14% \\ 33 & Depr. as a \% of fixed assets & 18% \\ 34 & Tax rate & 25% \\ 35 & Interest expense & $9,149 \\ 36 & Dividend payout ratio & 46.25% \\ \hline \end{tabular} Laiho Industries: Income Statement for Year Ending December 31, 2021 (in thousands of dollars) b. Constructing the statement of stockholders" equity for the year ending December 31, 2021, and the 2021 statement of cash flows 57 Laiho Industries: Statement of Stockholders" Equity, December 31, 2021 58 (in thousands of dollars) 67 Laiho Industries: Statement of Cash Flows for 2021 68 (in thousands of dollars) 69 Operating Activities 70 Net income 71 Depreciation and amortization 72 Increase in accounts payable 73 Increase in accruals 74 Increase in accounts receivable 75 Increase in inventories 76 Net cash provided by operating activities \begin{tabular}{|c|c|} \hline 2021 & Formulas \\ \hline & \#NHA \\ & \#NAB \\ & \#NHA \\ & \#NAB \\ & \#NAB \\ & \#NAB \\ \hline & \#NA \\ \hline \hline \end{tabular} 77 78 Investing Activities 88 89 Summary \begin{tabular}{l|l|l} 90 & Net increase/decrease in cash & \#NrA \\ 91 & Cash at the beginning of the year & \#NrA \\ 92 & Cash at the end of the year & \# \\ \hline 93 & \end{tabular} 94 c. Calculating 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF) 95 Excesss cash $0 101 After-tax cost of capital 9.5% 102 EVA cum (in thousands of dollars) 103 104 f. Calculating the firm's MVA at year-end 2021 105 Stock price 106 Shares outstanding \#A 107 MVA an (in thousands of dollars) \#NHPA Laiho Industries: Statement of Cash Flows for 2021 (thousands of dollars) 2021 c. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excess cash. NOWC 1020:$ thousand NOWC2021=$ thousand C. Caloulate 2020 and 2021 net operating working copital (NOWC) and 2021 free cash flow (FCF). Assurne the firm has no excess cash. NOWCC2020:$N2C2021:$F2021:$thousandthousandthousand d. If Laiho increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taxes paid by the comparry's shareholders? If Laibo increased its dividend payout ratio, the firm would pay corporate taxes and the company's shareholders would pay taxes on the dividends they would receive. e. Assume that the firm's after-tax cost of capital is 9.5%. What is the firm's 2021 EVA? thousand f. Assurne that the firm's stock price is $22 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021 ? thousand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts