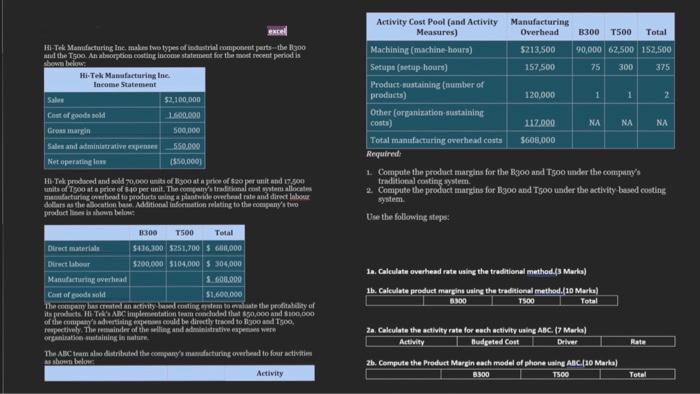

Question: could anyone help with this question? 75 excel Hi-Tek Manufacturing Inc. makes two types of industrial component parts--the B300 and the T500 An absorption costing

75 excel Hi-Tek Manufacturing Inc. makes two types of industrial component parts--the B300 and the T500 An absorption costing facie statement for the recent period is shown below Hi-Tek Manufacturing Inc. Income Statement Salve $2,100,000 Cost of goods sold 100.000 Grosir 500,000 Sales and administrative expenses 550.000 Net operating los ($50,000 Tek produced and sold 70.000 of ooste price of Saro per unit and 17.300 units of Tsoo at a price of $40 per unit. The company's traditional cost to allocates mfacturing wheel to products in a plastidorehead rate and direct labore dollars as the action base. Additional information relating to the company's to products shown belom Activity Cost Pool (and Activity Manufacturing Measures) Overhead B300 T500 Total Machining (machine-hours) $213,500 90,000 62,500 152,500 Setup (setup hours) 157,500 300 375 Product sustaining (number of products) 120,000 1 1 2 Other (organization sustaining costs) L12000 NA NA NA Total manufacturing overhead costs $608,000 Required: 1. Compute the product margins for the B30o and Too under the company's traditional conting system. 2 Compute the product margins for B300 and 'Too under the activity based costing system Use the following steps: 1. Calculate overhead rate using the traditional method. 3 Marks) 300 T500 Total Direct materials S436,500 $251,700 60,000 Direct labour $200,000 $104,000 S 304,000 Manufactured S600.000 Cost of goods sold $1,600.000 The pay has created an activity and continguem to late the profitability of its products. TAS ABC implementation to concluded that 50.000 and $100,000 of the cowy advertising could be directly trond to Band Tsco, respectively. The remainder of the selling and writive ape organisation staining in male The ABC tramaledistributed the company's manufacturing had to four activitim As shown below Activity 1b. Calculate product margins using the traditional method. 10 Marka 3.300 TSOO Total 2a. Calculate the activity rate for each activity using ABC (7 Marka Activity Budgeted Cout Driver Rate 2b. Compute the Product Margin each model of phone using ABC (10 Marka) 8.900 1500 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts