Question: Could I get an explanation on how you solve the Interest Expense? I understand how to solve for Interest Payable, and I know the formula.

Could I get an explanation on how you solve the Interest Expense? I understand how to solve for Interest Payable, and I know the formula. However, I'm struggling the most with understanding how to get the fraction of the year in the formula correct for Interest Expense. Thank you!

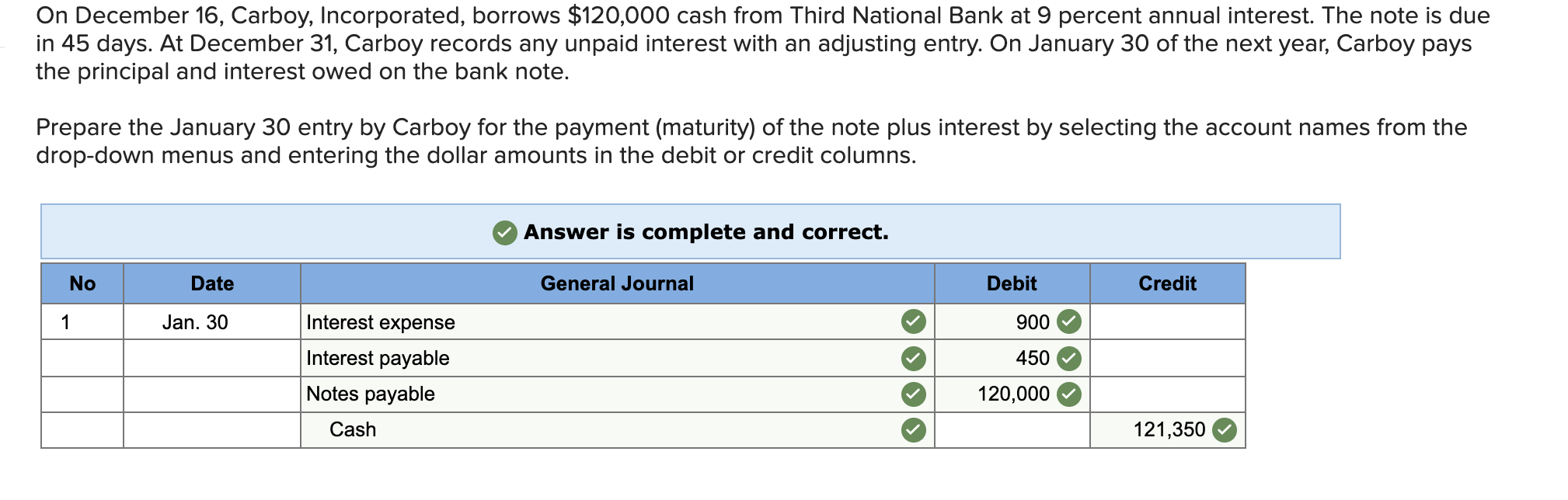

On December 16, Carboy, Incorporated, borrows $120,000 cash from Third National Bank at 9 percent annual interest. The note is due in 45 days. At December 31, Carboy records any unpaid interest with an adjusting entry. On January 30 of the next year, Carboy pays the principal and interest owed on the bank note. Prepare the January 30 entry by Carboy for the payment (maturity) of the note plus interest by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. Answer is complete and correct. No Date General Journal Debit Credit 1 Jan. 30 Interest expense 900 450 Interest payable Notes payable 120,000 Cash 121,350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts