Question: could i get help solving a,b,c, and d please? John and Jane 5 mith are a middle-class couple that spends $4,000.00 a month. John and

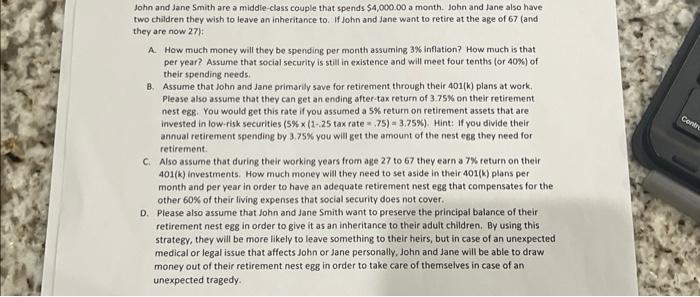

John and Jane 5 mith are a middle-class couple that spends $4,000.00 a month. John and Jane also have two children they wish to leave an inheritance to. If John and Jane want to retire at the age of 67 (and they are now 27): A. How much money will they be spending per month assuming 3% inflation? How much is that per year? Assume that social security is still in existence and will meet four tenths (or 40% ) of their spending needs. B. Assume that John and Jane primarily save for retirement through their 401(k) plans at work. Please also assume that they can get an ending after-tax return of 3.75% on their retirement nest egg. You would get this rate if you assumed a 5% return on retirement assets that are invested in low-risk securities (5%(225 tax rate =.75)=3.75%). Hint: If you divide their annual retirement spending by 3.75% you will get the amount of the nest egg they need for retirement. C. Also assume that during their working years from age 27 to 67 they earn a 7% return on their 401(k) investments. How much money will they need to set aside in their 401(k) plans per month and per year in order to have an adequate retirement nest egg that compensates for the other 60% of their living expenses that social security does not cover. D. Please also assume that John and Jane Smith want to preserve the principal balance of their retirement nest egg in order to give it as an inheritance to their adult children. By using this strategy, they will be more likely to leave something to their heirs, but in case of an unexpected medical or legal issue that affects John or Jane personally, John and Jane will be able to draw money out of their retirement nest egg in order to take care of themselves in case of an unexpected tragedy. John and Jane 5 mith are a middle-class couple that spends $4,000.00 a month. John and Jane also have two children they wish to leave an inheritance to. If John and Jane want to retire at the age of 67 (and they are now 27): A. How much money will they be spending per month assuming 3% inflation? How much is that per year? Assume that social security is still in existence and will meet four tenths (or 40% ) of their spending needs. B. Assume that John and Jane primarily save for retirement through their 401(k) plans at work. Please also assume that they can get an ending after-tax return of 3.75% on their retirement nest egg. You would get this rate if you assumed a 5% return on retirement assets that are invested in low-risk securities (5%(225 tax rate =.75)=3.75%). Hint: If you divide their annual retirement spending by 3.75% you will get the amount of the nest egg they need for retirement. C. Also assume that during their working years from age 27 to 67 they earn a 7% return on their 401(k) investments. How much money will they need to set aside in their 401(k) plans per month and per year in order to have an adequate retirement nest egg that compensates for the other 60% of their living expenses that social security does not cover. D. Please also assume that John and Jane Smith want to preserve the principal balance of their retirement nest egg in order to give it as an inheritance to their adult children. By using this strategy, they will be more likely to leave something to their heirs, but in case of an unexpected medical or legal issue that affects John or Jane personally, John and Jane will be able to draw money out of their retirement nest egg in order to take care of themselves in case of an unexpected tragedy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts