Question: Could I get help solving this? Thank you! ACCI302 mediate II Review Assignment Due January 17, 2023 (11:00 am) 20 pts. (3%s of overall grade)

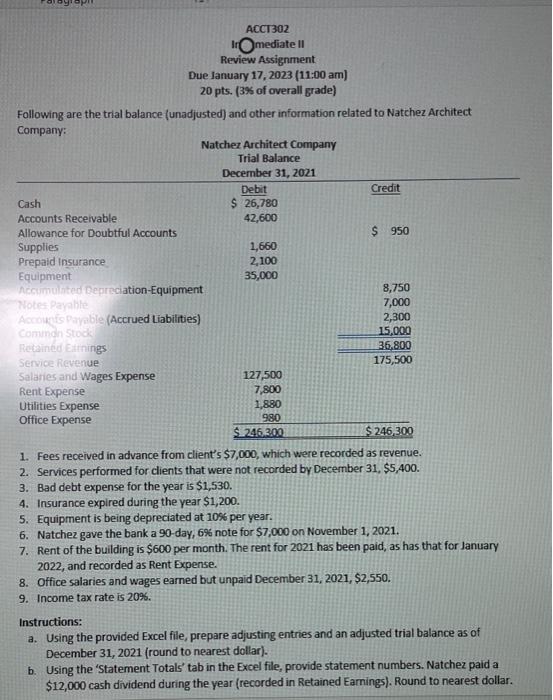

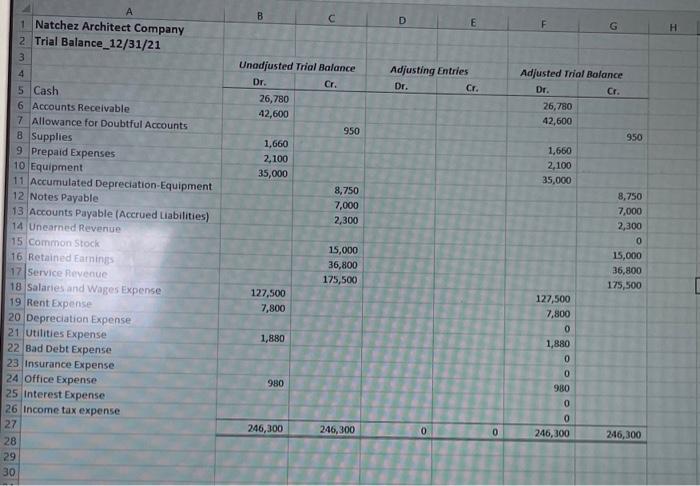

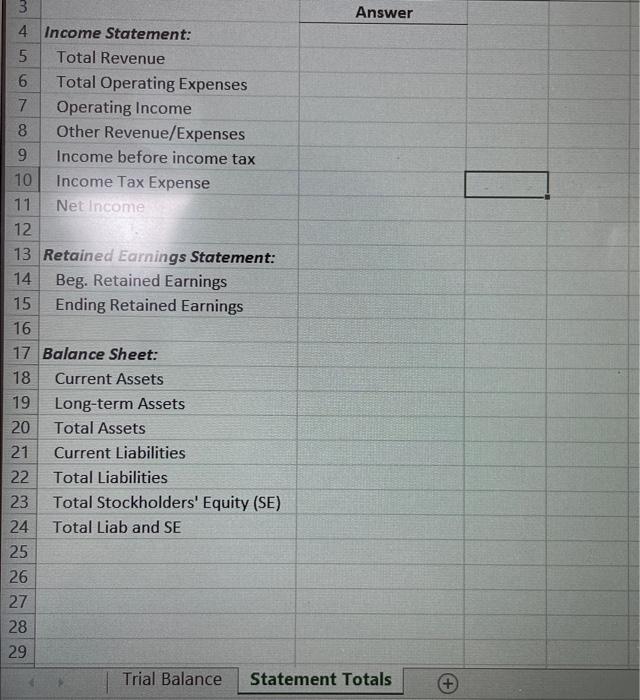

ACCI302 mediate II Review Assignment Due January 17, 2023 (11:00 am) 20 pts. (3\%s of overall grade) Following are the trial balance (unadjusted) and other information related to Natchez Architect Company: 1. Fees received in advance from client's $7,000, which were recorded as revenue. 2. Services performed for clients that were not recorded by December 31,$5,400. 3. Bad debt expense for the year is $1,530. 4. Insurance expired during the year $1,200. 5. Equipment is being depreciated at 10% per year. 6. Natchez gave the bank a 90-day, 69 note for $7,000 on November 1, 2021. 7. Rent of the building is $600 per month. The rent for 2021 has been paid, as has that for January 2022 , and recorded as Rent Expense. 8. Office salaries and wages earned but unpaid December 31,2021,$2,550. 9. Income tax rate is 209 . Instructions: a. Using the provided Excel file, prepare adjusting entries and an adjusted trial balance as of December 31,2021 (round to nearest dollar). b. Using the 'Statement Totals' tab in the Excel file, provide statement numbers. Natchez paid a $12,000 cash dividend during the year (recorded in Retained Earnings). Round to nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts