Question: could i get help with all please, and thank you in advance Bonds with a face value of $560000 and a quoted price of 102.25

could i get help with all please, and thank you in advance

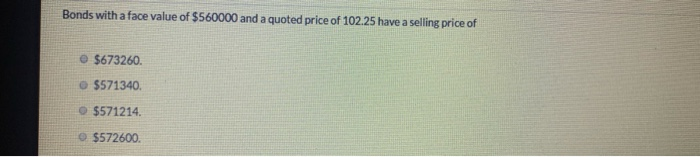

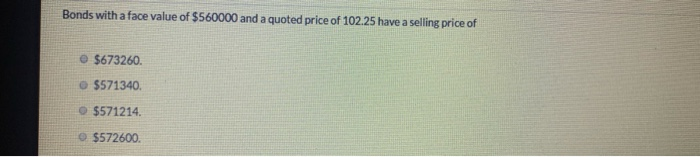

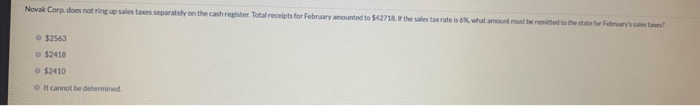

Bonds with a face value of $560000 and a quoted price of 102.25 have a selling price of $673260 $571340 $571214 $572600 Novak Corp. does not ring up sales taxes separately on the cash register. Totalreceipts for February amounted to $42718. the sales tax rate is what amount must be remitted to the state for February 52563 52418 52410 It cannot be determined On January 1, 2020, 54080000, 10-year, 10% bonds, were issued for $3957000. Interest is paid annually on January 1. If the issuing corporation uses the straight line method to amortize discount on bonds payable, the monthly amortization amount is $39570 512300 $2699 $1025

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock