Question: could i have help with question 2, 6 please. add reason why thank you 2. XRCO has a beta of 1.7. The annualized market return

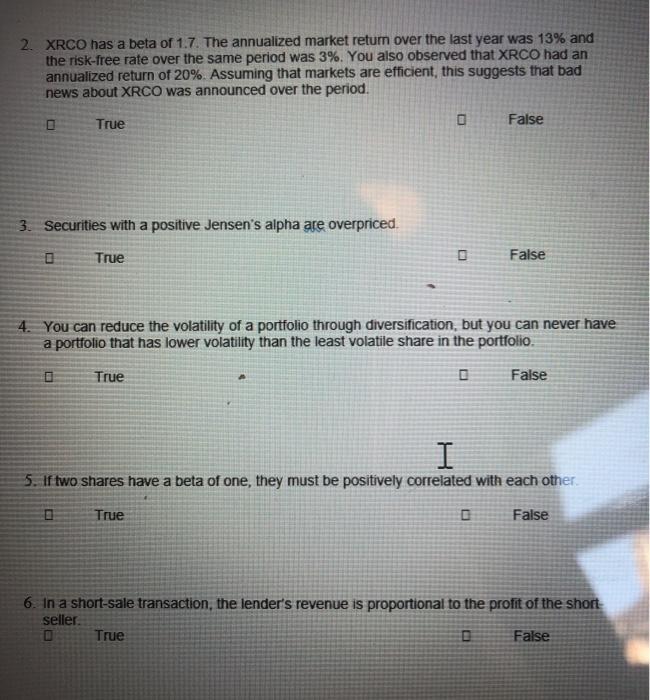

2. XRCO has a beta of 1.7. The annualized market return over the last year was 13% and the risk-free rate over the same period was 3%. You also observed that XRCO had an annualized return of 20%. Assuming that markets are efficient, this suggests that bad news about XRCO was announced over the period. True 0 False 3. Securities with a positive Jensen's alpha are overpriced. True 0 False 4. You can reduce the volatility of a portfolio through diversification, but you can never have a portfolio that has lower volatility than the least volatile share in the portfolio. True D False I 5. If two shares have a beta of one, they must be positively correlated with each other True False 6. In a short-sale transaction, the lender's revenue is proportional to the profit of the short seller. O True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts