Question: could i have help with these true and false question with the reasons why. thank you 7. According to the Carhart four-factor model, the lower

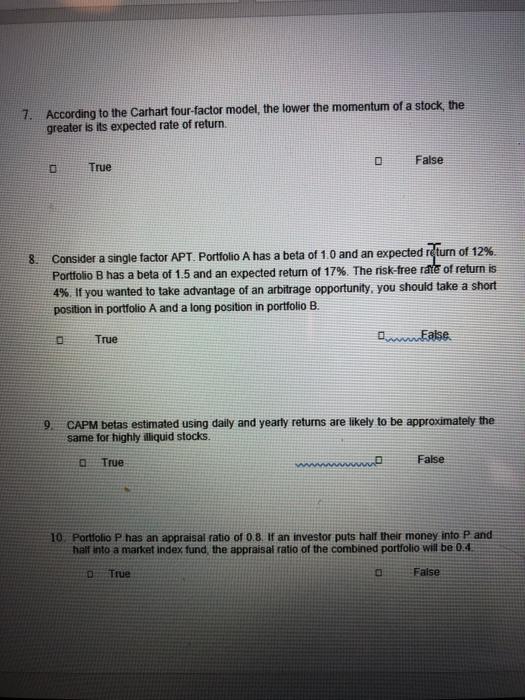

7. According to the Carhart four-factor model, the lower the momentum of a stock, the greater is its expected rate of return. False True 8. Consider a single factor APT. Portfolio A has a beta of 1.0 and an expected return of 12%. Portfolio B has a beta of 1.5 and an expected return of 17%. The risk-free rate of return is 4%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio A and a long position in portfolio B. True Ealse. 9 CAPM betas estimated using daily and yearly returns are likely to be approximately the same for highly illiquid stocks. True False 10 Portfolio P has an appraisal ratio of 0.8. If an investor puts half their money into P and half into a market index fund, the appraisal ratio of the combined portfolio will be 0.4 True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts