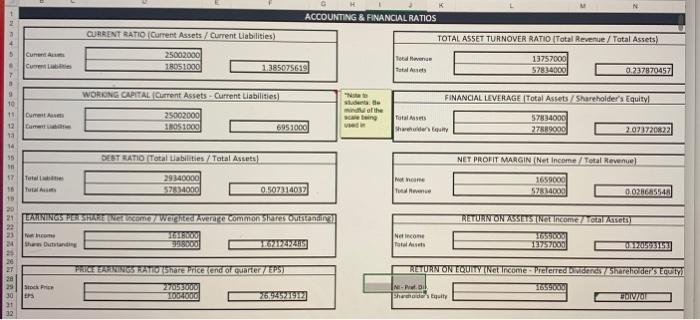

Question: could i please get help with the queations that pertain to the ratio chart? ACCOUNTING & FINANCIAL RATIOS CURRENT RATIO Current Assets / Current Liabilities)

ACCOUNTING & FINANCIAL RATIOS CURRENT RATIO Current Assets / Current Liabilities) TOTAL ASSET TURNOVER RATIO Total Revenue / Total Assets) Cum Current 25002000 1.8051000 To Me 1.385075619 13757000 57834000 0.237870457 WORONG CAPITAL Current Assets - Current Liabilities) FINANCIAL LEVERAGE Total Assets/Shareholder's Equity 9 10 11 12 Studente of the wing Cimet Cart 25002000 TROS 1000 6951000 Total Shwetu 57834000 27889000 2021720822 1 55 DEST EATIO Total abilities/Total Assets NET PROHIT MARGIN (Net Income Total Revenue) 17 Tota Tural 29340000 52140001 1659000 57814000 0.507114017 16 10 Tee 002685540 21 EARRINGS PETINGOMOZAWOCHE verre commons Recondi RETURN ON ASSETSTING Income to Nel com SERA SIRRARA 23 24 NO Share Outstanding ESCO HOS 12757000 PROCEEDINGSTATIONShare Price end of earterEPSI RETURN ONTQUITYT Net Income - Preferred And Shareholder's Equity Stock Phen To 900 30 T004000 2694 IN POR Shades BV 32 C. Bond Investment: [In one paragraph, analyze the risks and benefits of the business choosing to invest in a corporate bond, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis.] D. Capital Equipment: [In one paragraph, analyze the risks and benefits of the business choosing to invest in capital equipment, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis.) E. Capital Lease: [In one paragraph, analyze the risks and benefits of the business choosing to purchase a capital lease, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis.) 2. Financial Evaluation In this section of the report, you will evaluate the three available financial options for the business and recommend which option(s) are the best for the business to choose. A. Financing: [In one paragraph, explain how a business finances its operations and expansion.) B. Bond Investment: [In one paragraph, write your assessment on the appropriateness of a bond investment as an option for the business's financial health, using your financial analysis and other financial information to support your claims.) C. Capital Equipment: [In one paragraph, write your assessment on the appropriateness of a capital equipment investment as an option for the business's financial health, using your financial analysis and other financial information to support your claims.) D. Capital Lease: [In one paragraph, write your assessment on the appropriateness of a capital lease purchase as an investment option for the business's financial health, using your financial analysis and other financial information to support your claims.) E. Short-Term Financing: [In one paragraph, explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the business's current financial information.) F. Future Financial Considerations: [In one paragraph, describe the business's likely future financial performance based on its current financial well-being and risk level. Use financial information to support your claims.) 3. Financial Recommendation(s) [in 1 to 2 paragraphs, recommend the most appropriate financing option(s) based on the business's financial health, and include a rationale for why the option(s) are the best.) ACCOUNTING & FINANCIAL RATIOS CURRENT RATIO Current Assets / Current Liabilities) TOTAL ASSET TURNOVER RATIO Total Revenue / Total Assets) Cum Current 25002000 1.8051000 To Me 1.385075619 13757000 57834000 0.237870457 WORONG CAPITAL Current Assets - Current Liabilities) FINANCIAL LEVERAGE Total Assets/Shareholder's Equity 9 10 11 12 Studente of the wing Cimet Cart 25002000 TROS 1000 6951000 Total Shwetu 57834000 27889000 2021720822 1 55 DEST EATIO Total abilities/Total Assets NET PROHIT MARGIN (Net Income Total Revenue) 17 Tota Tural 29340000 52140001 1659000 57814000 0.507114017 16 10 Tee 002685540 21 EARRINGS PETINGOMOZAWOCHE verre commons Recondi RETURN ON ASSETSTING Income to Nel com SERA SIRRARA 23 24 NO Share Outstanding ESCO HOS 12757000 PROCEEDINGSTATIONShare Price end of earterEPSI RETURN ONTQUITYT Net Income - Preferred And Shareholder's Equity Stock Phen To 900 30 T004000 2694 IN POR Shades BV 32 C. Bond Investment: [In one paragraph, analyze the risks and benefits of the business choosing to invest in a corporate bond, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis.] D. Capital Equipment: [In one paragraph, analyze the risks and benefits of the business choosing to invest in capital equipment, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis.) E. Capital Lease: [In one paragraph, analyze the risks and benefits of the business choosing to purchase a capital lease, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis.) 2. Financial Evaluation In this section of the report, you will evaluate the three available financial options for the business and recommend which option(s) are the best for the business to choose. A. Financing: [In one paragraph, explain how a business finances its operations and expansion.) B. Bond Investment: [In one paragraph, write your assessment on the appropriateness of a bond investment as an option for the business's financial health, using your financial analysis and other financial information to support your claims.) C. Capital Equipment: [In one paragraph, write your assessment on the appropriateness of a capital equipment investment as an option for the business's financial health, using your financial analysis and other financial information to support your claims.) D. Capital Lease: [In one paragraph, write your assessment on the appropriateness of a capital lease purchase as an investment option for the business's financial health, using your financial analysis and other financial information to support your claims.) E. Short-Term Financing: [In one paragraph, explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the business's current financial information.) F. Future Financial Considerations: [In one paragraph, describe the business's likely future financial performance based on its current financial well-being and risk level. Use financial information to support your claims.) 3. Financial Recommendation(s) [in 1 to 2 paragraphs, recommend the most appropriate financing option(s) based on the business's financial health, and include a rationale for why the option(s) are the best.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts