Question: Could I please get some help on this problem? Thanks in advance Computing and Reporting Deferred Income Taxes Early in January 2016, Oler, Inc., purchased

Could I please get some help on this problem? Thanks in advance

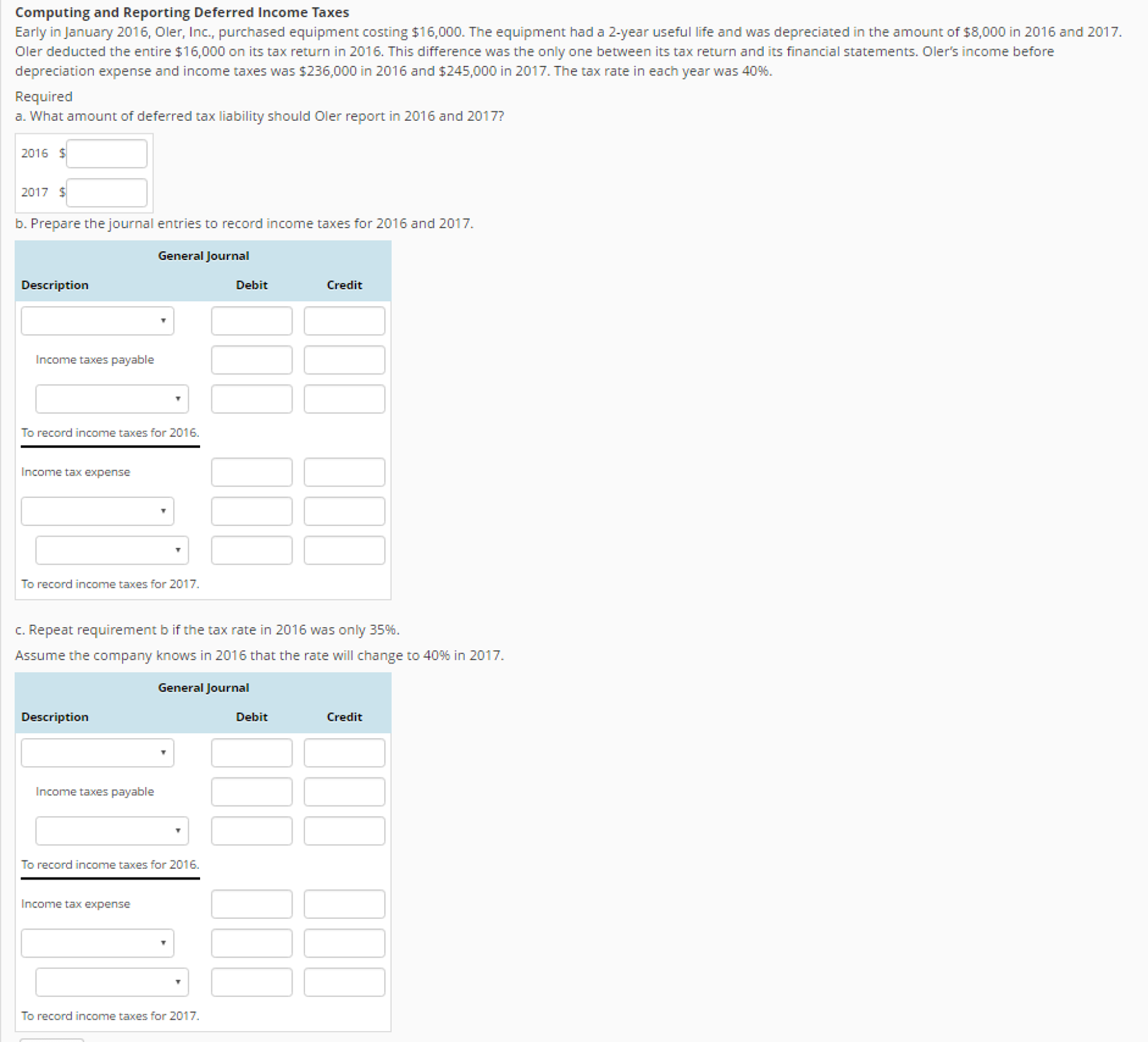

Computing and Reporting Deferred Income Taxes Early in January 2016, Oler, Inc., purchased equipment costing $16,000. The equipment had a 2-year useful life and was depreciated in the amount of $8,000 in 2016 and 2017. Older deducted the entire $16,000 on its tax return in 2016. This difference was the only one between its tax return and its financial statements. Oler's income before depreciation expense and income taxes was $236,000 in 2016 and $245,000 in 2017. The tax rate in each year was 40%. a. What amount of deferred tax liability should Oler report in 2016 and 2017? b. Prepare the journal entries to record income taxes for 2016 and 2017. c. Repeat requirement b if the tax rate in 2016 was only 35%. Assume the company knows in 2016 that the rate will change to 40% in 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts