Question: Could I please have help with required 3 and 4? saved Outback Outfitters sells recreational equipment. One of the company's products, a small camp stove,

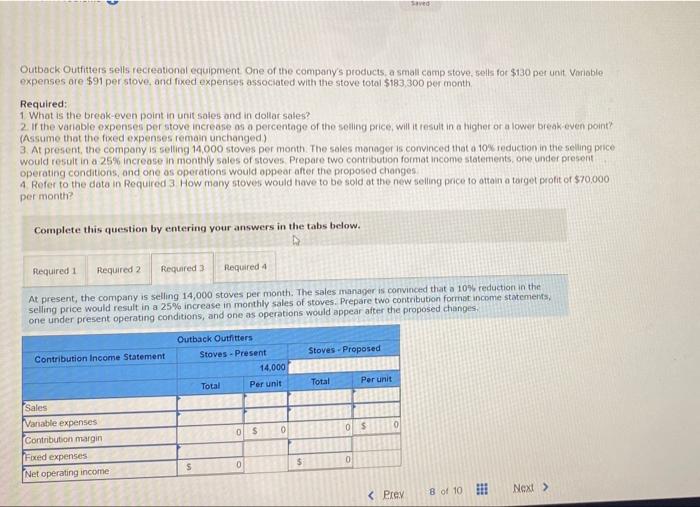

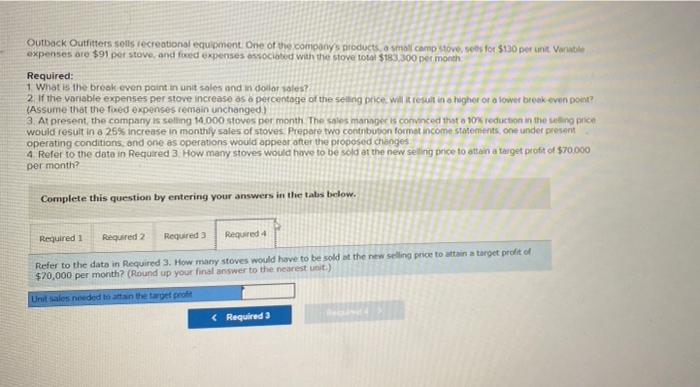

saved Outback Outfitters sells recreational equipment. One of the company's products, a small camp stove, sells for $130 per unit Variable expenses are $91 per stove, and fixed expenses associated with the stove total $183,300 per month Required: 1 What is the break-even point in unit sales and in dollar sales? 2. If the variable expenses per stove increase os o percentage of the selling price, will result in a higher or a lower break even point? (Assume that the fixed expenses remain unchanged) 3. At present the company is selling 14,000 stoves per month. The sales manager is convinced that a 10% reduction in the selling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one os operations would appear after the proposed changes 4 Refer to the data in Required 3 How many stoves would have to be sold at the new selling price to attain a target profit of $70,000 per month Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required 4 At present, the company is selling 14,000 stoves per month. The sales manager is convinced that a 10% reduction in the selling price would result in a 25% increase in monthly sales of stoves. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes Stoves - Proposed Contribution Income Statement Outback Outfitters Stoves - Present 14.000 Total Per unit Total Per unit Os 0 0 05 Sales Vanable expenses Contribution margin Fixed expenses Net operating income 0 5 0 Outback Outfitters sols recreational equipment. One of the company products a small camp stove, ces for $130 per unt varit expenses are $91 per stove and foued expenses associated with the stove total $183,300 per month Required: 1 What is the break even point in unit sales and in dollar sales? 2. If the variable expenses per stove increase as a percentage of the selle price will result in a tugher or a lower break even one? (Assume that the food expenses remain unchanged.) 3. At present the company is selling 14.000 stoves per month The sales manager is convinced that a 10% reduction in the sange would result in a 25% increase in monthly sales of stoves Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes 4 Refer to the data in Required 3. How many stoves would have to be sold at the new selling price to attain a target profit of $70.000 per month? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Refer to the data in Required 3. How many stoves would have to be sold at the new selling price to attain target profit of $70,000 per month? (Round up your final answer to the nearest unit.) Unit sales needed to attain the target profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts