Question: Could I please have the calculations, explanation, and answer for the red parts? Thank you so much! Wildhorse Company issued its 9%, 25-year mortgage bonds

Could I please have the calculations, explanation, and answer for the red parts? Thank you so much!

Could I please have the calculations, explanation, and answer for the red parts? Thank you so much!

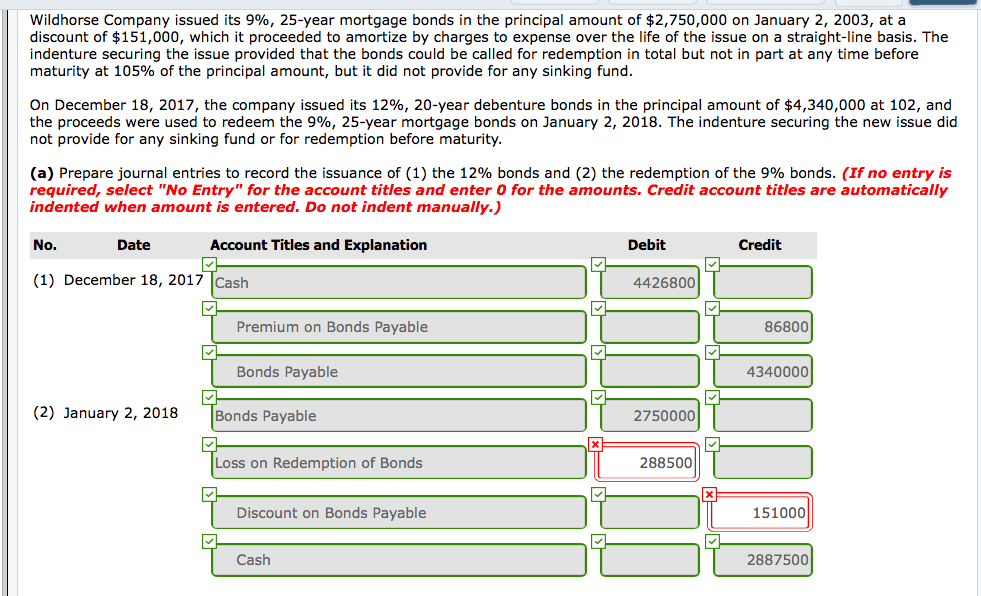

Wildhorse Company issued its 9%, 25-year mortgage bonds in the principal amount of $2,750,000 on January 2, 2003, at a discount of $151,000, which it proceeded to amortize by charges to expense over the life of the issue on a straight-line basis. The indenture securing the issue provided that the bonds could be called for redemption in total but not in part at any time before maturity at 105% of the principal amount, but it did not provide for any sinking fund On December 18, 2017, the company issued its 12%, 20-year debenture bonds in the principal amount of $4,340,000 at 102, and the proceeds were used to redeem the 996, 25-year mortgage bonds on January 2, 2018. The indenture securing the new issue did not provide for any sinking fund or for redemption before maturity. (a) Prepare journal entries to record the issuance of (1) the 12% bonds and (2) the redemption of the 9% bonds. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) 0. Date Account Titles and Explanation Debit Credit (1) December 18, 2017 Cash 4426800 Premium on Bonds Payable 86800 Bonds Payable 4340000 (2) January 2, 2018 Bonds Payable 2750000 Loss on Redemption of Bonds 288500 Discount on Bonds Payable 151000 Cash 2887500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts