Question: Could really use some quick help on this. Thank you SO much in advance! Problem 10-24 (LO 10-1, 10-3, 10-4) On December 18, 2017, Stephanie

Could really use some quick help on this. Thank you SO much in advance!

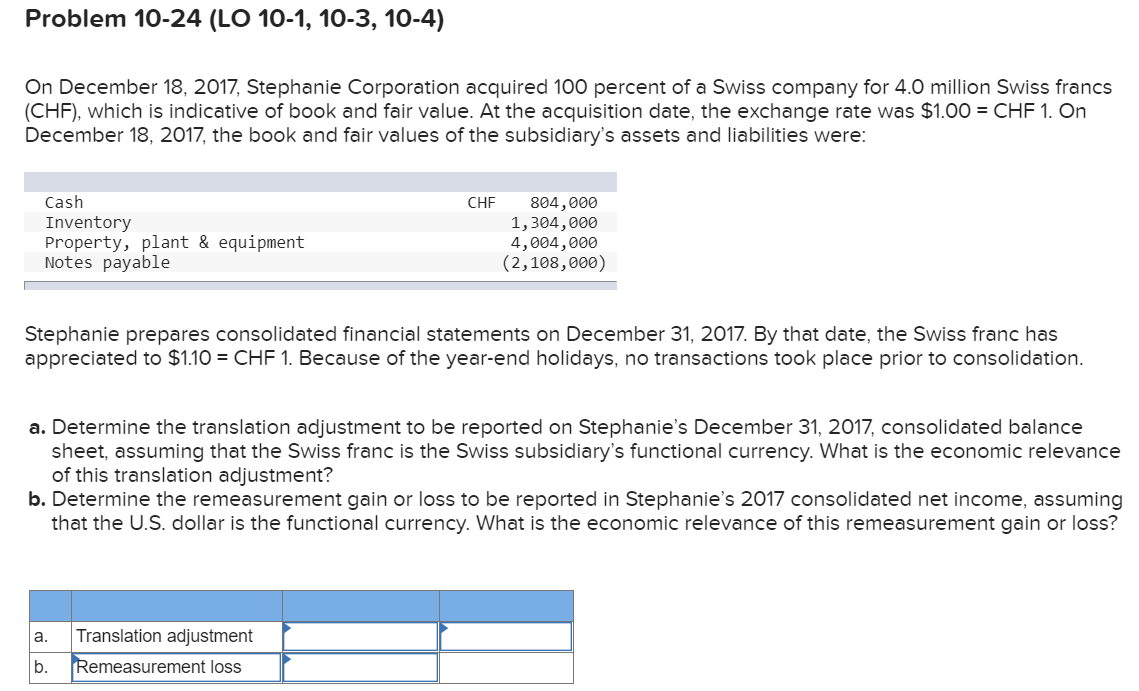

Problem 10-24 (LO 10-1, 10-3, 10-4) On December 18, 2017, Stephanie Corporation acquired 100 percent of a Swiss company for 4.0 million Swiss francs (CHF), which is indicative of book and fair value. At the acquisition date, the exchange rate was $1.00 = CHF 1. On December 18, 2017, the book and fair values of the subsidiary's assets and liabilities were: Cash Inventory Property, plant & equipment Notes payable CHF 804,000 1,304,000 4,004,000 (2,108,000) Stephanie prepares consolidated financial statements on December 31, 2017. By that date, the Swiss franc has appreciated to $1.10 = CHF 1. Because of the year-end holidays, no transactions took place prior to consolidation. a. Determine the translation adjustment to be reported on Stephanie's December 31, 2017, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary's functional currency. What is the economic relevance of this translation adjustment? b. Determine the remeasurement gain or loss to be reported in Stephanie's 2017 consolidated net income, assuming that the U.S. dollar is the functional currency. What is the economic relevance of this remeasurement gain or loss? a. Translation adjustment b. Remeasurement loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts