Question: Could somebody please help explain the answer my lecturer has given. The question and solution information is below. As you can see they have said

Could somebody please help explain the answer my lecturer has given.

The question and solution information is below.

As you can see they have said that call options should be purchased and not put options. I thought that you bought call options when the price is going up and put options when the forward price is going down. Since the price of the SF is going down I don't understand why this the recommendation.

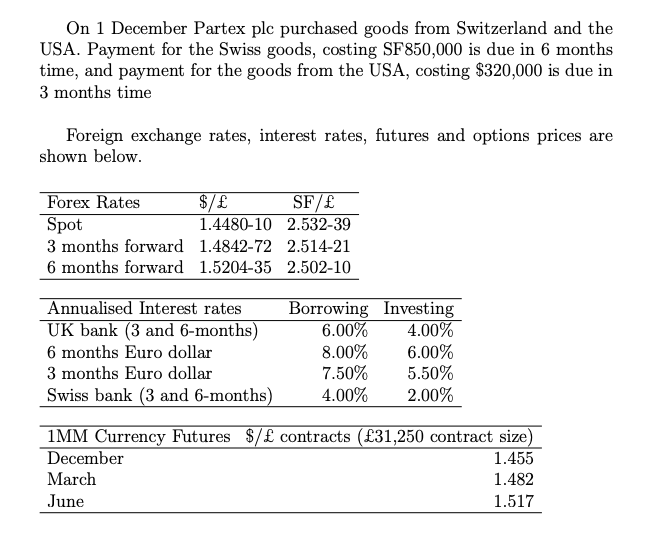

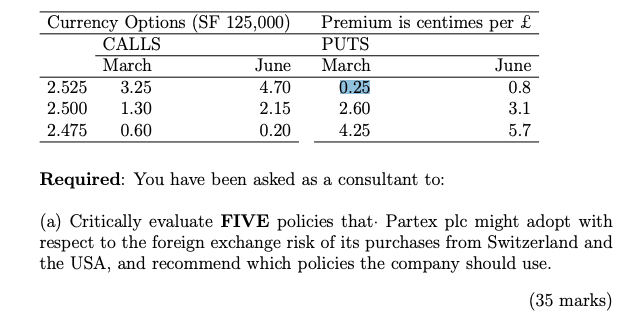

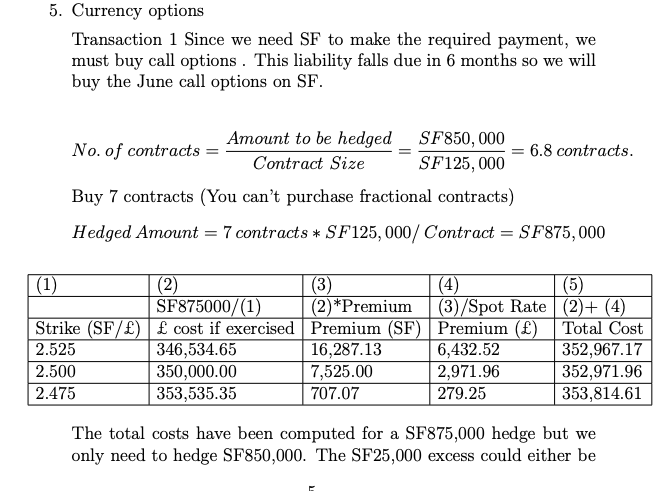

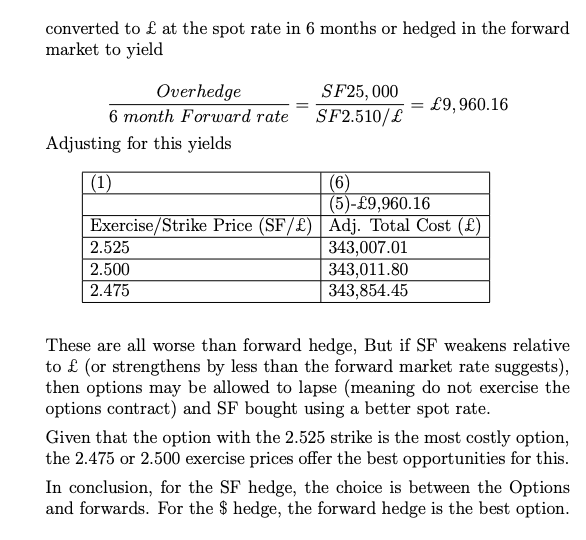

On 1 December Partex plc purchased goods from Switzerland and the USA. Payment for the Swiss goods, costing SF850,000 is due in 6 months time, and payment for the goods from the USA, costing $320,000 is due in 3 months time Foreign exchange rates, interest rates, futures and options prices are shown below. Forex Rates $/ SF/ Spot 1.4480-10 2.532-39 3 months forward 1.4842-72 2.514-21 6 months forward 1.5204-35 2.502-10 Annualised Interest rates UK bank (3 and 6-months) 6 months Euro dollar 3 months Euro dollar Swiss bank (3 and 6-months) Borrowing Investing 6.00% 4.00% 8.00% 6.00% 7.50% 5.50% 4.00% 2.00% IMM Currency Futures $/ contracts (31,250 contract size) December 1.455 March 1.482 June 1.517 Currency Options (SF 125,000) CALLS March June 2.525 3.25 4.70 2.500 1.30 2.15 2.475 0.60 0.20 Premium is centimes per PUTS March June 0.25 0.8 2.60 3.1 4.25 5.7 Required: You have been asked as a consultant to: (a) Critically evaluate FIVE policies that. Partex plc might adopt with respect to the foreign exchange risk of its purchases from Switzerland and the USA, and recommend which policies the company should use. (35 marks) 5. Currency options Transaction 1 Since we need SF to make the required payment, we must buy call options. This liability falls due in 6 months so we will buy the June call options on SF. Amount to be hedged SF850,000 No. of contracts 6.8 contracts. Contract Size SF125,000 Buy 7 contracts (You can't purchase fractional contracts) Hedged Amount = 7 contracts * SF125,000/ Contract SF875,000 (1) ( (2) (3) (4) (5) SF875000/(1) (2)*Premium (3)/Spot Rate (2)+ (4) Strike (SF/) cost if exercised Premium (SF) Premium () Total Cost 2.525 346,534.65 16,287.13 6,432.52 352,967.17 2.500 350,000.00 7,525.00 2,971.96 352,971.96 2.475 353,535.35 707.07 279.25 353,814.61 The total costs have been computed for a SF875,000 hedge but we only need to hedge SF850,000. The SF25,000 excess could either be converted to at the spot rate in 6 months or hedged in the forward market to yield Overhedge 6 month Forward rate Adjusting for this yields SF25,000 SF2.510/ 9,960.16 (1) (6 (5)-9,960.16 Exercise/Strike Price (SF/) Adj. Total Cost () 2.525 343,007.01 2.500 343,011.80 2.475 343,854.45 These are all worse than forward hedge, But if SF weakens relative to (or strengthens by less than the forward market rate suggests), then options may be allowed to lapse (meaning do not exercise the options contract) and SF bought using a better spot rate. Given that the option with the 2.525 strike is the most costly option, the 2.475 or 2.500 exercise prices offer the best opportunities for this. In conclusion, for the SF hedge, the choice is between the Options and forwards. For the $ hedge, the forward hedge is the best option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts