Question: could somebody please help me. 1. An increasing annuity pays annual instalments, of which the first one is R700, 6 months from now. The payments

could somebody please help me.

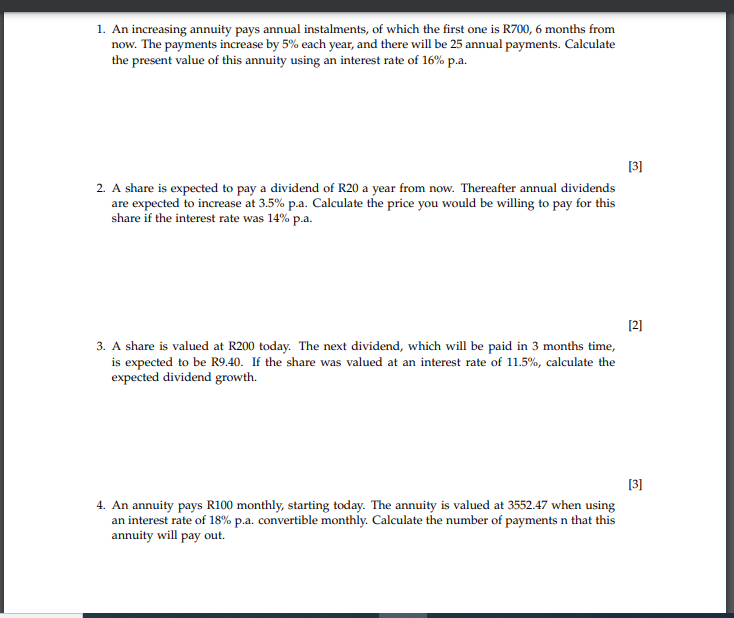

1. An increasing annuity pays annual instalments, of which the first one is R700, 6 months from now. The payments increase by 5% each year, and there will be 25 annual payments. Calculate the present value of this annuity using an interest rate of 16% p.a. [3] 2. A share is expected to pay a dividend of R20 a year from now. Thereafter annual dividends are expected to increase at 3.5% p.a. Calculate the price you would be willing to pay for this share if the interest rate was 14% p.a. [2] 3. A share is valued at R200 today. The next dividend, which will be paid in 3 months time, is expected to be R9.40. If the share was valued at an interest rate of 11.5%, calculate the expected dividend growth. [3] 4. An annuity pays R100 monthly, starting today. The annuity is valued at 3552.47 when using an interest rate of 18% p.a. convertible monthly. Calculate the number of payments n that this annuity will pay out

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts