Question: Could someone answer these step by step? Would help a lot. 1.James Corporation issued 2,000 shares of $5 par value common stock for $20 per

Could someone answer these step by step? Would help a lot.

Could someone answer these step by step? Would help a lot.

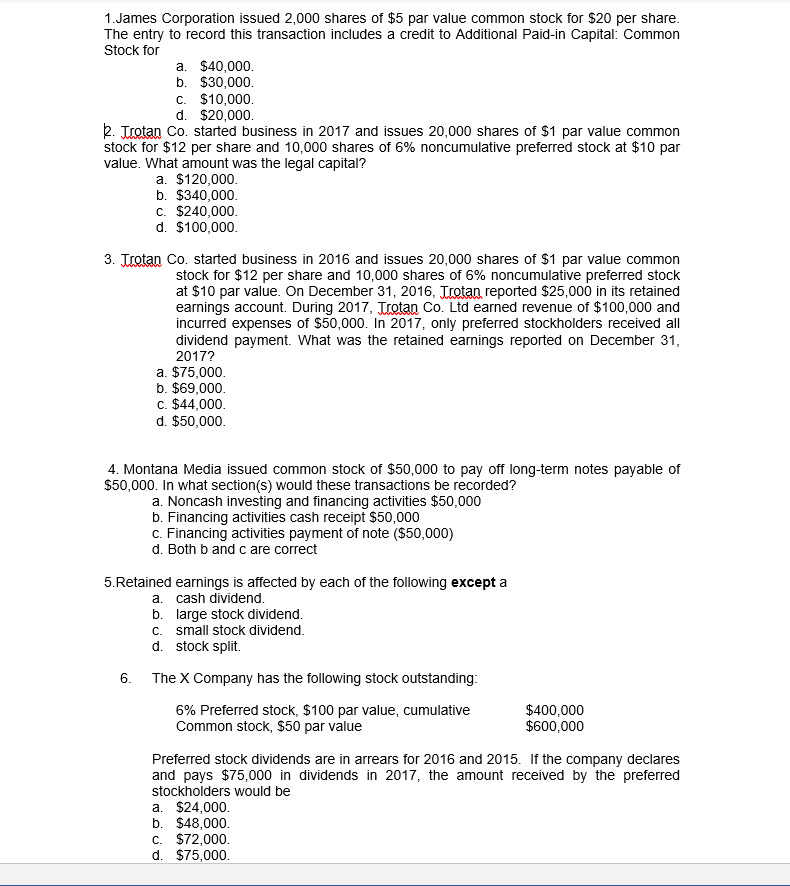

1.James Corporation issued 2,000 shares of $5 par value common stock for $20 per share The entry to record this transaction includes a credit to Additional Paid-in Capital: Common Stock foir a. $40,000 b. $30,000 C. $10,000 d. $20,000 2. Irotan Co. started business in 2017 and issues 20,000 shares of $1 par value common stock for $12 per share and 10,000 shares of 6% noncumulative preferred stock at $10 par value. What amount was the legal capital? a. $120,000 b. $340,000 C. $240,000 d. $100,000 3. Trotan Co. started business in 2016 and issues 20,000 shares of $1 par value common stock for $12 per share and 10,000 shares of 6% noncumulative preferred stock at $10 par value. On December 31, 2016, Irotan reported $25,000 in its retained earnings account. During 2017, Trotan Co. Ltd earned revenue of $100,000 and incurred expenses of $50,000. In 2017, only preferred stockholders received all dividend payment. What was the retained earnings reported on December 31 2017? a. $75,000 b. $69,000 c. $44,000 d. $50,000 4. Montana Media issued common stock of $50,000 to pay off long-term notes payable of $50,000. In what section(s) would these transactions be recorded? a. Noncash investing and financing activities $50,000 b. Financing activities cash receipt $50,000 c. Financing activities payment of note ($50,000) d. Both b and c are correct 5.Retained earnings is affected by each of the following except a a. cash dividend b. large stock dividend C. small stock dividend d. stock split. 6. The X Company has the following stock outstanding $400,000 $600,000 6% Preferred stock, $100 par value, cumulative Common stock, $50 par value Preferred stock dividends are in arrears for 2016 and 2015. If the company declares and pays $75,000 in dividends in 2017, the amount received by the preferred stockholders would be a. $24,000 b. $48,000 C. $72,000 d. $75,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts