Question: Could someone answer this for me as SOON as possible?? Thank you in advance!!! When a company collects from a customer who pays within the

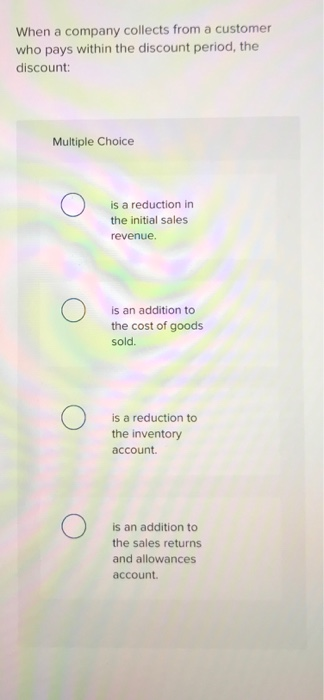

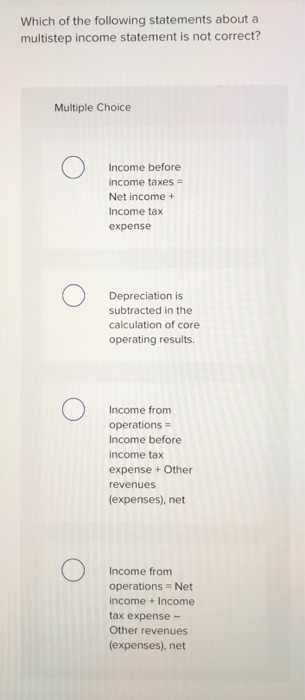

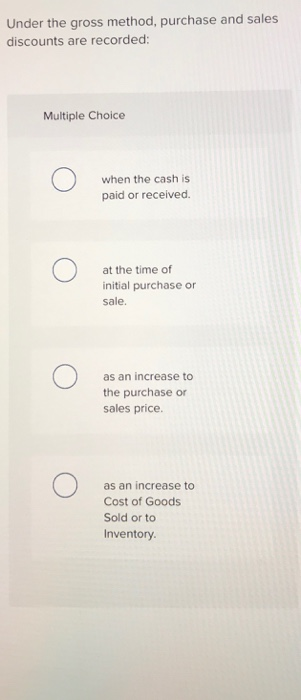

When a company collects from a customer who pays within the discount period, the discount: Multiple Choice is a reduction in the initial sales revenue. is an addition to the cost of goods sold. is a reduction to the inventory account is an addition to the sales returns and allowances account. Which of the following statements about a multistep income statement is not correct? Multiple Choice Income before income taxes = Net income + Income tax expense Depreciation is subtracted in the calculation of core operating results. Income from operations = Income before income tax expense + Other revenues (expenses), net Income from operations = Net income + Income tax expense - Other revenues (expenses), net Under the gross method, purchase and sales discounts are recorded: Multiple Choice 0 when the cash is paid or received. 0 at the time of initial purchase or sale. 0 as an increase to the purchase or sales price. 0 as an increase to Cost of Goods Sold or to Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts